Nvidia is a leading semiconductor company with a market cap over $2 trillion, second only to Apple. Its financial strength, vertical integration, and dominance in AI and networking have solidified its position in the market. Competitors face the challenge of aligning with or competing against Nvidia. Intel’s UXL consortium aims to create open-source software as an alternative to Nvidia’s CUDA platform in the AI market.

What do we think? Although one player currently dominates the tech landscape, the industry has demonstrated rapid changes in recent years. Observing how these dynamics evolve in the coming years will be important in judging the market’s development. Competitive solutions range from the highly novel to the remarkably prosaic. As a highly vertically integrated supplier, Nvidia puts a moat around everything from hardware to software, and ecosystems will develop in response on both sides of the moat.

Nvidia, the giant

Nvidia has achieved a remarkable milestone as a semiconductor company with a market cap exceeding $2 trillion (depending upon the current share price). This valuation places it as the second most respected semiconductor company, surpassed only by Apple. With an annual revenue rate nearing $100 billion, Nvidia’s financial prowess is evident, constituting approximately one-sixth of the global semiconductor industry’s revenue.

The company’s financial performance is underpinned by robust margins that are continuously improving. Operating at impressive gross and net levels, Nvidia generates a remarkable free cash flow equivalent to 40% of its revenue. This cash further solidifies its position in the market (though proportionate spending on R&D has fallen as the company has grown).

One key aspect of Nvidia’s success lies in its vertical integration across hardware and software domains. By utilizing dense integration techniques and incorporating technologies like NVLink and NVSwitch as interconnect fabrics, Nvidia has developed advanced systems such as the DGX platform that can be scaled to accommodate thousands of chips. These systems are optimized to efficiently run the proprietary CUDA software stack and cater to diverse industry verticals through application optimizations.

In the realm of AI, Nvidia stands out as a dominant player, particularly excelling in AI training. Notably, in its recent earnings report, a significant portion of the data center revenue (40%) was attributed to inferencing tasks, showcasing the company’s wide-ranging expertise.

Despite being in operation for over 30 years, Nvidia maintains a founder-led approach, embodying the agility and innovation characteristic of a start-up. With a flat organizational structure and an impressive personal net wealth exceeding $70 billion for its CEO, Jensen Huang, Nvidia operates at the forefront of technological advancement.

Considering Nvidia’s unparalleled position in the semiconductor industry, businesses face a crucial question: How do they compete with or strategically align with Nvidia and its ecosystem for mutual benefit?

There are noticeable shifts happening in the vertical structure of businesses, especially in terms of software frameworks and direct deployment onto various accelerators. The development of systems that can meet high-performance standards remains a viable option for some competitors, such as AMD or Intel. However, it is still a very significant challenge when competing against Nvidia with its astonishingly strong momentum. To succeed in such a competitive landscape, it’s crucial to tailor solutions to meet the specific needs of the market where they will be deployed and to innovate by a considerable margin—just a little better is not enough.

What about price? Nvidia could be much cheaper: The margin on its top-end GPUs is in the hundreds of percent, and at the lower end, 60–90%. Price is not the deciding factor, as much cheaper competitors like Graphcore have found out.

Moreover, in the realm of networking, Nvidia has excelled in advancing bandwidth capabilities at a pace faster than its competitors thought possible, partly due to its acquisition of Mellanox. While Nvidia currently holds a significant market share, other companies like AMD are making strides to compete, with products such as the MI300 showing promising performance. These developments indicate a potential shift towards more integrated systems rather than solely focusing on individual components like chips.

In the hyperscale computing sector, Nvidia’s dominance is evident through its substantial presence in the capital expenditure budgets of major players like Microsoft and Meta. Efforts to develop proprietary hardware are underway in these companies, highlighting a trend towards increased self-sufficiency.

Today, numerous start-ups have begun to develop various services that rely on hardware from Nvidia, which will further empower them. People generally favor winners, especially when a clear winner is emerging. In the era of personal computers, we had the Wintel duopoly with Intel for hardware and Microsoft for software. Now, we have Nvidia working on hardware at different levels—chip, Internet, software stack, applications, and an expanding library of AI tools.

UXL, the slingshot

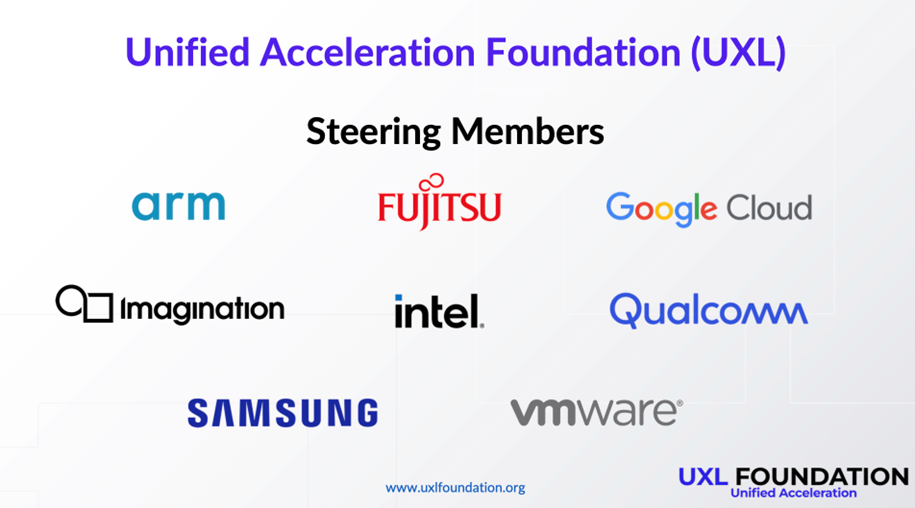

Last year, Intel established an open-source consortium named the Unified Acceleration Foundation (UXL), which comprises eight prominent AI chip and software companies. Among these companies, Intel takes the lead in terms of technology. Other key members include Alphabet, Samsung, Qualcomm, VMware (Broadcom), Arm, Fujitsu, and Imagination Technologies.

The primary objective of this consortium is to develop open-source software capable of functioning with any variety of AI chipsets. This initiative benefits Intel as a competitor to Nvidia, as well as cloud platforms like Alphabet, which currently rely on purchasing costly and high-margin Nvidia chips. UXL aims to cover not just CPUs and GPUs, but also other accelerator architectures.

They say their mission is to:

- Build a multi-architecture, multi-vendor software ecosystem for all accelerators.

- Unify the heterogeneous compute ecosystem around open standards.

- Build on and expand open-source projects for accelerated computing.

Now, according to The Register, the UXL Foundation is readying its open-standard accelerator programming model, touted as an alternative to Nvidia’s CUDA platform, for “a spec release in Q4.”

“Our ultimate aim is to foster a multi-architecture and multi-vendor programming platform for all accelerators,” said Rod Burns, VP ecosystem–Codeplay and UXL Foundation Steering Committee chair.

This sort of standardization has been the bedrock of the mobile market and will be essential if there is going to be an alternative to Nvidia in regard to AI.

There are numerous AI accelerator architectures mooted using techniques from photonics to analog, but whatever the hardware innovations, without software standardization, Nvidia’s GPUs will beat them into pixels.

“We already have a mature specification for many of the fundamentals needed,” Burns told The Register.

Perhaps sensing things shifting, Nvidia recently doubled down on its CUDA EULA to much general guffawing around the world, but especially in China, Germany, and other territories where EULAs are weakly enforceable.

Reuters makes it all sound very dramatic, talking about “plans to loosen Nvidia’s choke hold by going after the chip giant’s secret weapon: the software that keeps developers tied to Nvidia chips” and “an expanding group of financiers and companies hacking away at Nvidia’s dominance in AI.”

It is just classic competition. If a market is attractive, people will seek to enter it. Sometimes that’s disruption—I’m excited about the potential for silicon photonics for faster, lower-power inferencing, for example—and sometimes it’s just gradually filling in the moats and building your own ecosystem.