Jon Peddie Research (JPR), the industry's research and consulting firm for graphics and multimedia, announced estimated PC graphics add-in-board (AIB) shipments and suppliers’ market share for Q2'15.

JPR’s AIB Report tracks computer add-in graphics boards, which carry discrete graphics chips. AIBs used in desktop PCs, workstations, servers, and other devices such as scientific instruments. They are sold directly to customers as aftermarket products, or are factory installed. In all cases, AIBs represent the higher end of the graphics industry using discrete chips and private high-speed memory, as compared to the integrated GPUs in CPUs that share slower system memory.

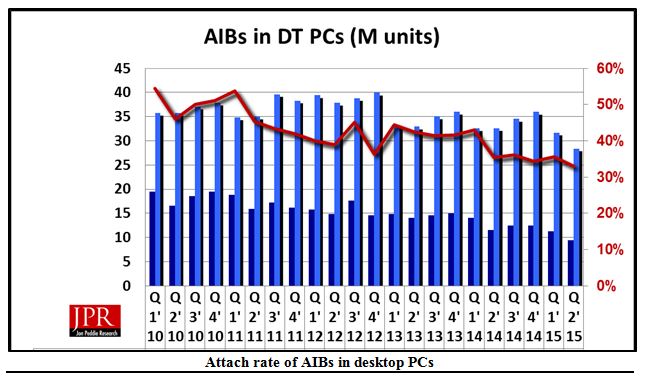

The news was discouraging and seasonally understandable, quarter-to-quarter, the AIB market decreased -16.81% (compared to the desktop PC market, which decreased -14.77%).

On a year-to-year basis, we found that total AIB shipments during the quarter fell -18.77%, which is more than desktop PCs, which fell -6.52%.

However, in spite of the overall decline, somewhat due to tablets and embedded graphics, the PC gaming momentum continues to build and is the bright spot in the AIB market.

The overall PC desktop market increased quarter-to-quarter including double-attach—the adding of a second (or third) AIB to a system with integrated processor graphics—and to a lesser extent, dual AIBs in performance desktop machines using either AMD’s Crossfire or Nvidia’s SLI technology.

The attach rate of AIBs to desktop PCs has declined from a high of 63% in Q1 2008 to 37% this quarter.

The quarter in general

JPR found that AIB shipments during the quarter behaved according to past years with regard to seasonality, but the increase was less than the 10-year average. AIB shipments decreased -16.81% from the last quarter (the 10-year average is -8.7% ).

Total AIB shipments decreased this quarter to 9.4 million units from last quarter.

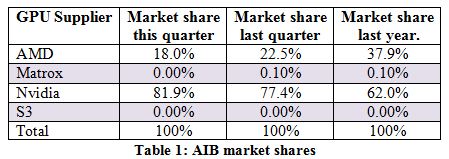

AMD’s quarter-to-quarter total desktop AIB unit shipments decreased -33.3% .

Nvidia’s quarter-to-quarter unit shipments decreased -12.0% Nvidia continues to hold a dominant market share position at 81.9% .

Figures for the other suppliers were flat to declining.

The change from year to year decreased -18.8% compared to last year.

This quarter compared to quarter-to-quarter percentage changes for the vendors are shown in Table 1.

The AIB market has benefited from the enthusiast segment PC growth, which has been partially fueled by recent introductions of exciting new powerful board.

The demand for high-end PCs and associated hardware from the enthusiast and overclocking segments has bucked the downward trend and given AIB vendors a needed prospect to offset declining sales in the mainstream consumer space.

An example of this consequence helping to push up prices for suppliers’ product lines was Nvidia’s introduction of the GeForce GTX Titan X in March. Offered at the shocking price of $999, the Titan set a new level for the most expensive single-GPUAIB.

That had a halo effect on Nvidia’s other AIBs and when the GeForce GTX 980 Ti was introduced in June, it was considered as having a price-performance ratio justifying its relatively high price of $649, and it sold very well.

New “gaming” monitors were introduced by Acer, LG, and others with wide formats, screen resolutions of 2560 x 1440, and reasonable prices in the sub $400 range. Such offerings will help stimulate the demand for new AIBs in Q3.

In the years we have been tracking the market, we have seen AIBs evolve from un-programmable graphics controllers with 256 KB, to GPUs, to dual GPUs, and 12 MB AIBs that could be overclocked and water-cooled. Those improvements in performance, and the value for money and AIB represents, have been driven by the demand for more and more by the high-end enthusiast gamer, and the rest of the industry has benefited.

The AIB market now has just four chip (GPU) suppliers, who also build and sell AIBs. The primary suppliers of GPUs are AMD and Nvidia. There are 48 AIB suppliers, the AIB OEM customers of the GPU suppliers, which they call “partners.”

In addition to privately branded AIBs offered worldwide, about a dozen PC suppliers offer AIBs as part of a system, and/or as an option, and some that offer AIBs as separate aftermarket products.

We have been tracking AIB shipments quarterly since 1987—the volume of those boards peaked in 1999, reaching 114 million units, in 2013 65 million shipped.

The term “AIB” is an abbreviation for add-in board, also called a “card.” A “GPU” is the graphic processor unit on the AIB, also called the “chip.”

Graphics add-in board are without doubt one of the most powerful, exciting, and essential components in the PC market today: not only does every computer require one (or more) but the technology is entering into major new markets like supercomputers, remote workstations, and simulators almost on a daily basis. It would be little exaggeration to say that the AIB resembles the 800-pound gorilla in the room.

JPR’s AIB Report tracks computer add-in graphics boards, which carry discrete graphics chips. AIBs are used in desktop PCs, workstations, servers, and other devices such as scientific instruments. They are sold directly to customers as aftermarket products, or are factory installed. In all cases, AIBs represent the higher end of the graphics industry using discrete chips and private high-speed memory, as compared to the integrated GPUs in CPUs that share slower system memory.

It is critical to get a proper grip on this highly complex technology and understand its future direction.

This detailed 66-page report will provide you with all the data, analysis and insight you need to clearly understand where this technology is today and where it's headed.

This fact and data-based report does not pull any punches: frankly, you will be shocked by some of the analysis and insight.

Our findings include AIBs for Desktops, workstations, and PC-based commercial (i.e., POS) and industrial/scientific and embedded. This report does not include the x86 game consoles, handhelds (i.e., mobile phones), x86 Servers or ARM-based Tablets (i.e. iPad and Android-based Tablets), or ARM-based Servers. It does include x86-based tablets, Chromebooks, and embedded systems.

We have been providing quarterly reports on the PC graphics market shipments since 1987.

The report contains the following content:

- Market Forecasts: Supporting charts that project the supplier’s shipments over the period 2001 to 2017..

- AIBs: History, Status, and Analysis;

- A (Scary) Vision of the future: Building upon a solid foundation of facts, data and sober analysis, this section pulls together all of the report's findings and paints a vivid picture of where the PC graphics market is headed. Some may find the material in this section highly disturbing;

- Latest AIB developments. Included with this report is an analysis of the latest AIB offering and benchmark information for new products introduced in the quarter.

Pricing and Availability

Jon Peddie Research's AIB Report is available now in both electronic and hard copy editions and sells for $1,500. Included with this report is an Excel workbook with the data used to create the charts, the charts themselves, and supplemental information. The annual subscription price for JPR's AIB Report is $4,000 and includes four quarterly issues. Full subscribers to JPR services receive TechWatch (the company's bi-weekly report) and are eligible for a 10% discount. Bundle packages are also available. For information about purchasing the AIB Report, please call 415/435-9368 or visit the Jon Peddie Research website at www.jonpeddie.com.

JPR also publishes a series of reports on the PC Gaming Hardware Market, which covers system and accessories and looks at 31 countries. More information can be found here: http://www.jonpeddie.com/publications/pc_gaming_hardware_market_report/.

Contact Robert Dow at JPR ([email protected]) for a free sample of TechWatch.

About Jon Peddie Research

Dr. Jon Peddie has been active in the graphics and multimedia fields for more than 30 years. Jon Peddie Research is a technically oriented multimedia and graphics research and consulting firm. Based in Tiburon, California, JPR provides consulting, research, and other specialized services to technology companies in a variety of fields including graphics development, multimedia for professional applications and consumer electronics, high-end computing, and Internet-access product development. Jon Peddie Research's AIB Report is a quarterly report focused on the market activity of PC graphics controllers for notebook and desktop computing.

Company Contact:

Robert Dow, Jon Peddie Research

415/435-9368

View all JPR press releases: http://www.jonpeddie.com/about/press/index.shtml