Jon Peddie Research (JPR), the industry's research and consulting firm for graphics and multimedia, announced estimated graphics chip shipments and suppliers’ market share for 2013 4Q. The quarter was the second quarter in a row to show a gain in shipments, up 1.6% quarter-to-quarter, and up 2% compared to the same quarter last year.

Quick highlights:

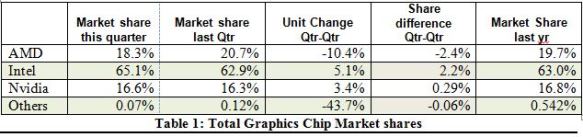

• AMD’s overall unit shipments decreased 10.4%, quarter-to-quarter, Intel’s total shipments increased 5.1% from last quarter, and Nvidia’s increased 3.4%.

• The attach rate of GPUs to PCs for the quarter was 137% and 34% of PCs had discrete GPUs that means 66% of the PCs are using embedded graphics.

• The overall PC market increased 1.8% quarter-to-quarter, but declined 8.5% year-to-year.

Most of the PC vendors are guiding down to flat for the next quarter.

The popularity of tablets and the persistent economic slowness are the most often mentioned reasons for the decline in the PC market. The one bright spot in the PC market has been the growth of gaming PCs where discrete GPUs play a significant role. The CAGR for total PC graphics from 2013 to 2017 is -1.3% in 2013, 446 million GPUs were shipped and the forecast for 2017 is 422 million.

The ten-year average change for graphics shipments for quarter-to-quarter is -2 %. This quarter is 1.6% suggesting the market may have bottomed out and is slowly recovering—however, one quarter does not a market make, up or down.

Our findings include discrete and integrated graphics (CPU and chipset) for Desktops, Notebooks (and Netbooks), and PC-based commercial (i.e., POS) and industrial/scientific and embedded. This report does not include handhelds (i.e., mobile phones), x86 Servers or ARM-based Tablets (i.e. iPad and Android-based Tablets), or ARM-based Servers. It does include x86-based tablets, and x86-based Chromebooks.

The quarter in general

• AMD’s shipments of desktop APUs (heterogeneous GPU/CPUs) jumped 15% from the previous quarter but declined 26.7% in notebooks. AMD’s discrete desktop shipments increased 1.8%, and notebook discrete shipments declined 6.7%. The company’s overall PC graphics shipments decreased 10.4%. Notebook build cycles are specific, and AMD was late with its new parts.

• Intel’s desktop processor-graphics EPG shipments increased from last quarter by 5.2%, and Notebooks increased by 5.1%. The company’s overall PC graphics shipments increased 5.1%.

• Nvidia’s desktop discrete shipments were up 3.6% from last quarter; and its notebook discrete shipments increased 3.2%. The company’s overall PC graphics shipments increased 3.4%.

• Year-to-year this quarter AMD’s overall PC graphics shipments declined 5.4%, Intel increased 5.4%, Nvidia increased 0.9%, and Others fell 77% from last year.

• Total discrete GPU (desktop and notebook) shipments were up 1.5% from the last quarter and down 2.4% from last year for the same quarter due to the same problems plaguing the overall PC industry. Overall, the trend for discrete GPUs is roughly flat with a CAGR from 2013 to 2017 of-1.3%

• Ninety nine percent of Intel’s non-server processors have graphics, and over 67% of AMD’s non-server processors contain integrated graphics; AMD still ships integrated graphics chipsets (IGPs).

Year-to-year for the quarter, the graphics market decreased. Shipments were down 1.6 million units from this quarter last year, which suggests the big declines are leveling off.

Graphics chips (GPUs) and chips with graphics (IGPs, APUs, and EPGs) are a leading indicator for the PC market. At least one and often two GPUs are present in every PC shipped. It can take the form of a discrete chip, a GPU integrated in the chipset or embedded in the CPU. The average has grown from 1.2 GPUs per PC in 2001 to almost 1.4 GPUs per PC.

Pricing and Availability

The Jon Peddie Research's Market Watch is available now in both electronic and hard copy editions, and sells for $2,500. Included with this report is an Excel workbook with the data used to create the charts, the charts themselves, and supplemental information. The annual subscription price for JPR's Market Watch is $4,000 and includes four quarterly issues. Full subscribers to JPR services receive Tech Watch (the company's bi-weekly report) and a copy of Market Watch as part of their subscription. For information about purchasing Market Watch, please call 415/435-9368 or visit the Jon Peddie Research website at http://www.jonpeddie.com.

Contact Robert Dow at JPR ([email protected]) for a free sample of TechWatch.

About Jon Peddie Research

Dr. Jon Peddie has been active in the graphics and multimedia fields for more than 30 years. Jon Peddie Research is a technically oriented multimedia and graphics research and consulting firm. Based in Tiburon, California, JPR provides consulting, research, and other specialized services to technology companies in a variety of fields including graphics development, multimedia for professional applications and consumer electronics, high-end computing, and Internet-access product development. Jon Peddie'sMarket Watch is a quarterly report focused on the market activity of PC graphics controllers for notebook and desktop computing.

Company Contact:

Jon Peddie, Jon Peddie Research

415/435-9368

[email protected]

Robert Dow, Jon Peddie Research

415/435-9368

[email protected]

Agency Contact:

Pat Meier-Johnson, Pat Meier Associates

415/389-1700

[email protected]

View all JPR press releases http://www.jonpeddie.com/about/press/index.shtml