Intel’s transformation is proving more expensive and painful than originally thought. But is this an overreaction?

Intel’s transformation is proving more expensive and painful than originally thought. But is this an overreaction?

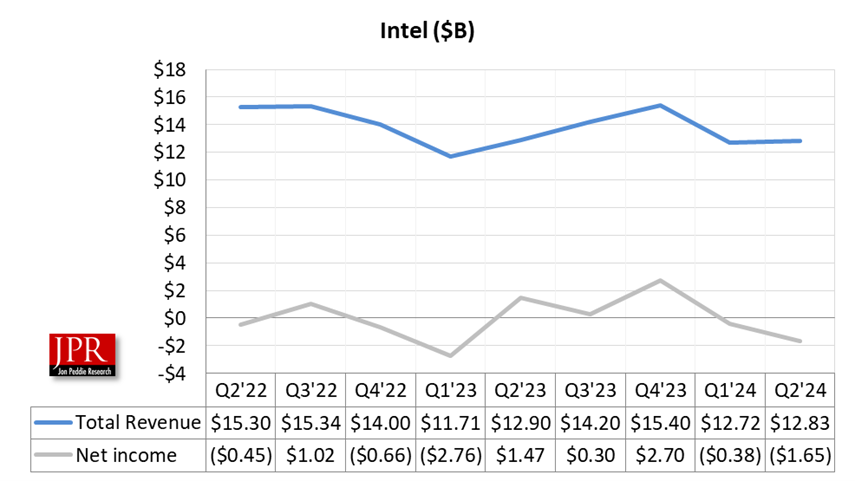

What do we think? Intel’s road to being the next TSMC hit a major speed bump. Revenue was off, net income was way off, it’s taking a significant restructuring hit, and 15,000 people are about to become jobless. CEO Pat Gelsinger told Barron’s the decisions were painful but necessary and that the company has hit key milestones but needs to refocus on efficiency to meet its “ambitious plan” for the future.

The signs were there. Intel delayed its earnings by a week after first saying it would announce on July 25, something it almost never does. Then, the night before earnings, rumors of massive layoffs began to float around X/Twitter. Now, we see there is something to those rumors.

The company also cancelled its dividend, something it has not done since 1989. After the cancellation in 1989, the company resumed paying dividends in 1990 and has continued to do so up till now.

If AMD had had a bad quarter, we could say it is due to the macroeconomic and overall market conditions because both companies were suffering from the same problems. But AMD had a great quarter (so did Qualcomm) and gave strong guidance. Intel had a bad quarter and gave weak guidance. The problem is with Intel.

The issue is, where do you cut? It is not a bloated company, and it has never been known for bloat. It operates very efficiently, and it has managed to keep expenses under control. R&D and MG&A have held steady for years. The plan reduction in R&D and headcount simply doesn’t seem proportional to the losses they are incurring, and reductions in R&D never end well.

The poorly performing GPU group is a likely candidate for pruning. There was not a single mention of Arc on the earnings call or in the press release.

If you look at the quarterly numbers versus the same in 2023, they are fairly flat, with no real jumps in expenses or drops in income. The one exception is restructuring costs, nonrecurring expense that in this quarter accounted for almost $1 billion. The problem is all of the expenses related to its transformation. The question then becomes how much pain Intel shareholders will be willing to endure.

Intel releases Q2 numbers, and storm clouds are gathering

Intel on Thursday reported it will be cutting 15,000 jobs, suspending its dividend, issuing disappointing earnings results, and providing ever weaker guidance.

For the second quarter, Intel reported revenue of $12.8 billion, just shy of the $12.9 billion projected by analysts and down 1% year over year. Second-quarter GAAP earnings (loss) were a loss of $1.6 billion, or ($0.38) earnings per share (EPS), while non-GAAP earnings were about $100 million, or $0.02 EPS—well below Wall Street’s consensus estimate of $0.10, according to FactSet.

Intel provided a revenue forecast range of $12.5 billion to $13.5 billion for the current quarter, which was below the consensus call of $14.4 billion. To make matters worse, the company will suspend its dividend in the fourth quarter as a cost-saving move. In the second quarter, it paid out $500 million in dividends.

On the earnings call with Wall Street analysts, CEO Pat Gelsinger said reductions will be across all segments of CapEx and yield $10 billion in direct savings in 2025, “and provide clear line of sight to a sustainable model, with the ongoing financial resources and liquidity needed to support our long-term strategy.”

“We reiterate our long-term commitment to a competitive dividend as cash flows improve to sustainably higher levels,” Gelsinger added. “We remain confident that we have, and will, continue to make the investments needed to drive long-term shareholder value. And we do cost discipline as the compass that drives effective execution.”

Gelsinger said Intel is taking steps to be “a world-class, fabless company, and these are significant structural steps.” He said that under IDM 1.0, Intel wasn’t built for efficiency, it was built for leadership. Now that it is focused on efficiency, the company sees a lot of opportunities in all the business units and has directed all its business units to look at new ways to grow their business, he added.

On the analyst call, CFO David Zinsner said there were three main drivers for the bad quarter. The largest impact was caused by an accelerated ramp of the company’s AI PC products, the decision to accelerate the transition of Intel 4 and 3 wafers from the company’s development fab in Oregon to its high-volume facility in Ireland, where wafer costs are higher in the near term. Finally, it saw an unfavorable product mix and more competitive pricing than expected in Q2.

Intel’s plan for cost reduction

Intel has four major priorities for its restructuring and initiative to get costs under control. They are:

Reducing operating expenses: The company will streamline its operations and meaningfully cut spending and headcount, reducing non-GAAP R&D and marketing, general, and administrative (MG&A) to approximately $20 billion in 2024 and approximately $17.5 billion in 2025, with further reductions expected in 2026. Intel expects to reduce headcount by greater than 15%, with the majority completed by the end of 2024.

Reducing capital expenditures: Intel will reduce gross capital expenditures in 2024 by more than 20% from prior projections to between $25 billion and $27 billion. Intel expects net capital spending in 2024 of between $11 billion and $13 billion. In 2025, the company is targeting gross capital expenditures between $20 billion and $23 billion, and net capital spending between $12 billion and $14 billion.

Reducing cost of sales: The company expects to generate $1 billion in savings in non-variable cost of sales in 2025. Product mix will continue to be a headwind next year, contributing to modest year-over-year improvements to 2025’s gross margin.

Maintaining core investments to execute strategy: The company continues to advance its long-term innovation and path to leadership across process technology and products, and the increased efficiency from its actions is expected to further support its execution.

Intel’s financial results for the quarter

Intel previously announced the implementation of an internal foundry operating model beginning in Q1 2024, which created a foundry relationship between its Intel Products business (collectively the client, data center, and networking groups) and its Intel Foundry business (including Foundry Technology Development, Foundry Manufacturing and Supply Chain, and Foundry Services, formerly IFS).

The company also previously announced its intent to operate the Altera FPGA unit as a stand-alone business beginning in the first quarter of 2024. Altera was previously included in Data Center and AI’s (DCAI’s) segment results. To account for these changes, the company modified its DCAI segment reporting in the first quarter of 2024 to align with this new operating model.

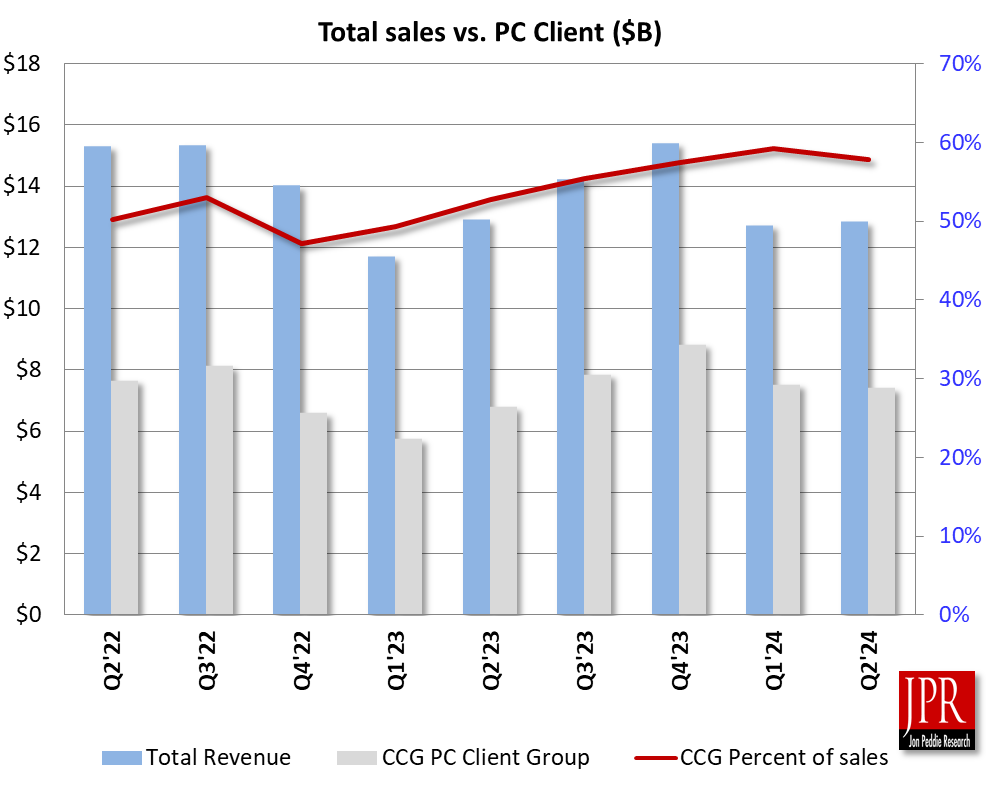

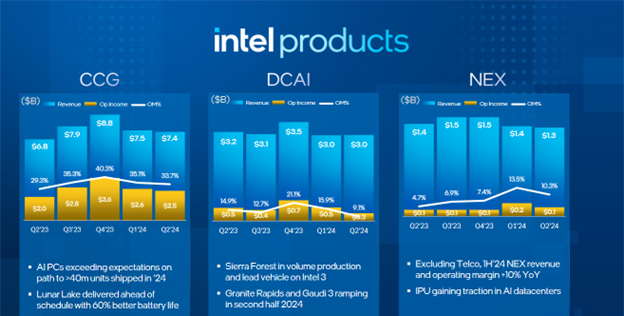

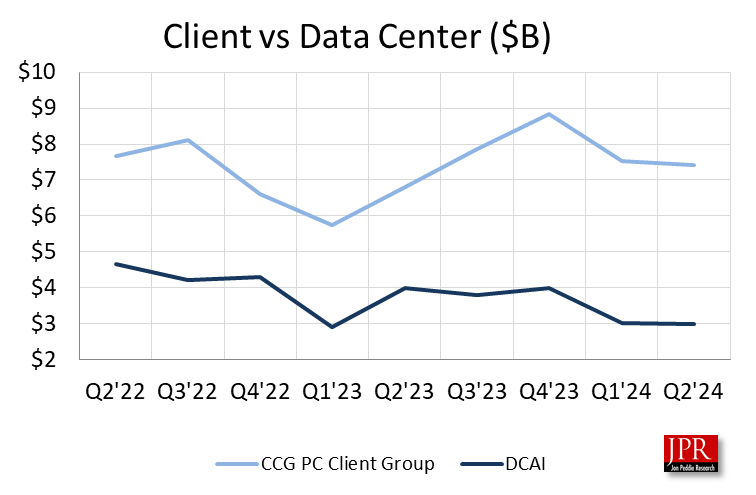

The Client Computing Group (CCG): Driven by sales of AI PC chips, the client business was up 9% year over year to $7.4 billion. Intel is on track to ship more than 40 million AI PC chips by year-end. Lunar Lake, the company’s next-generation AI CPU, was released to production in July 2024, ahead of schedule, with shipments starting in the third quarter.

Data Center and AI (DCAI): DCAI slipped 3% year over year to $3 billion. There were no new product launches, but there were introductions in the quarter. At Computex, Intel introduced its next-generation Xeon 6 processor with Performance cores (P-cores), code-named Granite Rapids, and Efficiency cores (E-cores), code-named Sierra Forest. Both generations are expected to ship in the third quarter. Also shipping in the third quarter is Intel’s Gaudi 3 AI accelerator, designed to compete with Nvidia’s enterprise GPU technology.

Networking and Edge (NEX): NEX dipped 1% to $1.3 billion. In the quarter, Intel announced an array of AI-optimized scale-out Ethernet solutions, including the Intel AI network interface card and foundry chiplets that will launch next year. New infrastructure processing unit (IPU) adaptors for the enterprise are now broadly available.

Outlook

For the third quarter, Intel forecasts weaker spending across consumer and enterprise markets, especially in China, and continued focus on AI server investments in the cloud. Thus, it has reduced its TAM expectations for 2024.

As a result, customer inventory levels are elevated. “We expect customers to reduce inventory over the second half of the year, along with the continued modest negative impact from export controls. These market dynamics should result in below seasonal revenue growth in Q3, with the client business flat to down and modest growth in data center and its markets—with an expectation of healthier inventory positions exiting the quarter,” said Zinsner.

As a result of these factors, Intel expects revenue of $12.5 billion to $13.5 billion in the third quarter, with a midpoint of $13 billion. The company expects gross margin of approximately 38%, with a tax rate of 13% and EPS of ($.03) on a non-GAAP basis.