TIBURON, CA (September 24, 2024)—According to a new research report from leading analyst firm Jon Peddie Research (JPR), unit shipments in the add-in board (AIB) market increased in Q2’24 from last quarter and increased year over year. Meanwhile, Nvidia slightly increased market share from last quarter, as well as year over year.

In Q2’24, total graphics card shipments increased to 9.5 million units, up from 8.7 million units last quarter.

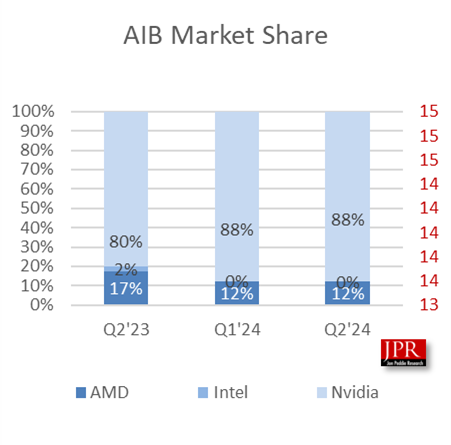

AMD’s quarter-to-quarter total desktop AIB unit shipments increased 9% and increased 3% from last year. Nvidia’s quarter-to-quarter unit shipments increased 9.7% and increased 61.9% from last year while continuing to hold a dominant market share position at 88%. Intel, which entered the AIB market in Q3’22 with the Arc A770 and A750, remained flat, as the company has yet to gain significant traction in the add-in board market.

Quick Highlights

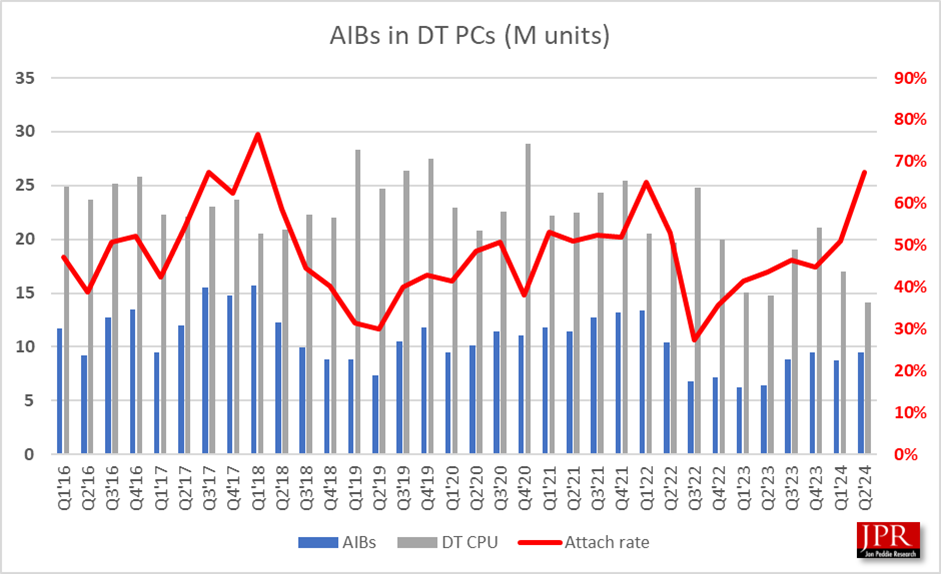

- JPR found that AIB shipments during the quarter increased from the last quarter by 9.4%, which is above the 10-year average of -7.1%.

- Total AIB shipments increased by 48% this quarter from last year to 9.5 million units and were up from 8.7 million units last quarter.

- AMD’s quarter-to-quarter total desktop AIB unit shipments increased 9% and increased 3% from last year.

- Nvidia’s quarter-to-quarter unit shipments increased 9.7% and increased 61.9% from last year. Nvidia continues to hold a dominant market share position at 88%.

- AIB shipments from year to year increased by 48% compared to last year.

Shown in the following chart are the quarter-to-quarter and year-to-year market share percentages for the vendors, and the total unit shipments.

The second quarter is typically flat to down compared to the previous quarter. This quarter was up by 9.4%, which is above the 10-year average of -7.1%. The surge in shipments defies normal seasonality.

“The add-in board market continues to surprise and astonish market watchers who have been predicting its doom for decades. With one little dip in Q1 (seasonally normal), we’ve seen four quarters of growth,” said Dr. Jon Peddie, president of Jon Peddie Research. “But, overall shipments are down compared to two years ago, so that’s not encouraging. However, we remain optimistic about the future, and the fantastic games that are coming that will take all the performance an AIB can offer.”

C. Robert Dow, analyst for Jon Peddie Research, added: “The increase in shipments in Q2 bucks normal seasonality; the surge can be attributed to the release of new AIBs in Q1 and a slight drop in prices in the market overall. Prices should remain flat until next-generation AIBs are released in late 2024 or 2025.”

Pricing and availability

Jon Peddie Research’s AIB report is now available and sells for $3,000. The annual subscription price for JPR’s AIB report is $6,000 and includes four quarterly issues and four hours of consulting. Subscribers to JPR’s TechWatch are eligible for a 10% discount. Bundled packages are also available. For information about purchasing the AIB report, please call (415) 435-9368 or visit the Jon Peddie Research website at http://www.jonpeddie.com/.

About Jon Peddie Research

Jon Peddie Research has been active in the graphics and multimedia fields for more than 30 years. JPR is a technically oriented multimedia and graphics research and consulting firm. Based in Tiburon, California, JPR provides consulting, research, and other specialized services to technology companies in various fields, including graphics development, multimedia for professional applications and consumer electronics, high-end computing, and Internet-access product development. JPR’s Market Watch is a quarterly report focused on PC graphics controllers’ market activity for notebook and desktop computing.

Company contact:

Jon Peddie, Jon Peddie Research

(415) 435-9368

jon@jonpeddie.com

Robert Dow, Jon Peddie Research

(415) 407-0757

robert@jonpeddie.com

Media contact:

Carol Warren, Creor Group

(714) 890-4500

carol@creorgroup.com