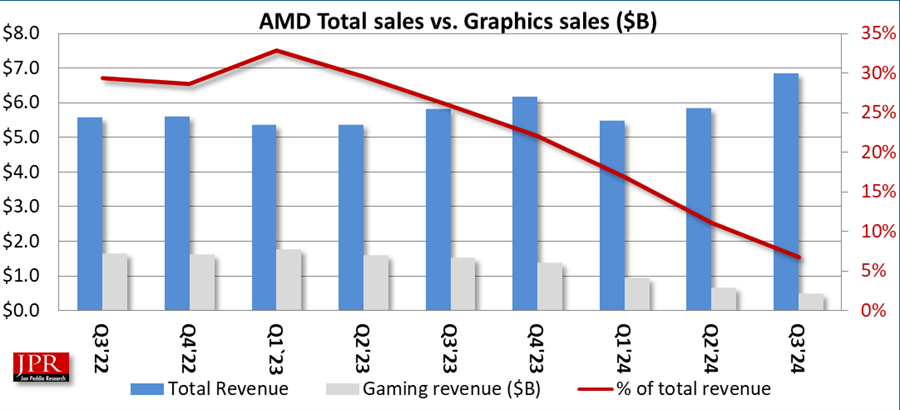

AMD’s data center business now accounts for the majority of the company’s sales, even though client sales are strong. Gaming and embedded sales are another story.

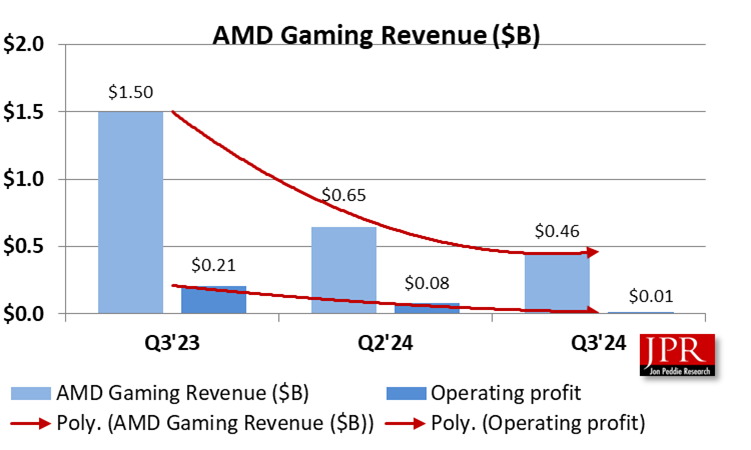

What do we think? RIP AMD’s GPU business. It has been on a steady decline over the last few years and now accounts for just 7% of AMD’s revenue. The GPU business is contributing mightily to AMD’s revenue in the form of the Instinct AI accelerator, which had three times the revenue of gaming ($1.5 billion for Instinct vs. $460 million for gaming).

This is backed up by our own numbers. According to our “Q2 Market Watch” report, AMD had just 8% market share.

But perhaps we should not predict gaming’s demise just yet. After all, the Instinct accelerator is based on GPU technology. So, like Nvidia, we expect to see the data center side of things take priority over the gaming side.

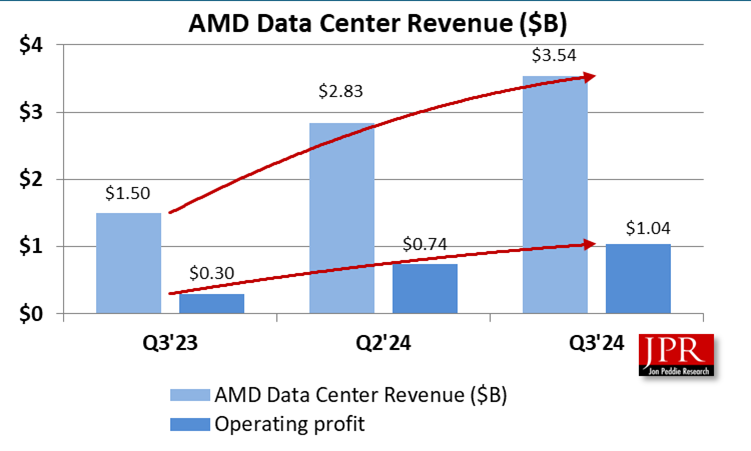

And why not? Instinct revenue accounted for $1.5 billion of the $3.5 billion in data center sales, meaning accelerators are selling almost as well as CPUs after less than a year on the market. AMD has raised its projection of Instinct sales for this year from $4.5 billion to $5 billion. Whether it’s because customers see value in Instinct or they simply can’t get Hopper products, AMD’s accelerator business has taken off like a shot.

What’s really remarkable is that margins in the accelerator business are below AMD’s corporate average, according to CFO Jean Hu. “Once we continue to ramp the revenue, we think we’ll have the opportunity to continue to improve gross margin,” she said during a conference call with Wall Street analysts. “When you think about it, this is a data center business. Over the longer term, it tends to be better than [our] corporate average. We’ll take some time to get there.”

It’s ironic that Intel is trying to transform itself into TSMC, while AMD is transforming itself into Nvidia.

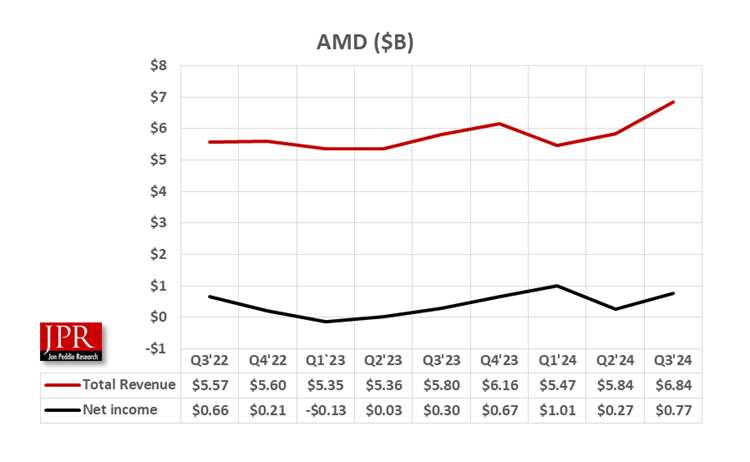

AMD Q3 2024 earnings beat revenue expectations

On Tuesday, AMD announced revenue for the third quarter of 2024 of $6.8 billion, an 18% rise over the same period last year. Gross margin was 50%, an improvement over the 47% in Q3 2023. Operating income jumped 223% over last year to $724 million, while net income of $771 million and earnings per share of $0.47 were 158% above the same period last year.

On a non-GAAP basis, the gross margin was 54%, operating income was $1.7 billion, net income was $1.5 billion, and diluted earnings per share were $0.92.

“We delivered strong third-quarter financial results, with record revenue led by higher sales of Epyc and Instinct data center products and robust demand for our Ryzen PC processors,” said AMD Chair and CEO Lisa Su in a statement. “Looking forward, we see significant growth opportunities across our data center, client, and embedded businesses driven by the insatiable demand for more compute.”

The data center segment’s revenue accounted for 52% of total revenue for the quarter, the first time the data center has led the way. Notable events in the quarter included the launch of the Epyc 9005 series (Turin), the introduction of the Instinct MI325X accelerators, and the planned acquisition of ZT Systems, which specializes in data center system deployment.

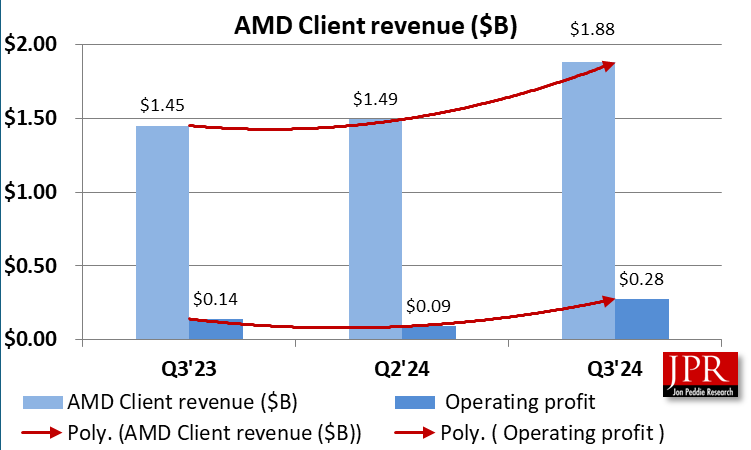

Client segment revenue was $1.9 billion, up 29% year over year and 26% sequentially. Notable events in the quarter include ramping up production of AMD Ryzen 9000 series processors based on the Zen 5 architecture and preparing for the launch of next-gen Ryzen 9000 X3D processors in Q4’24.

The company also introduced new Ryzen AI Pro 300 series mobile processors with AI co-processors, delivering 50-plus AI TOPS and extended battery life.

Gaming segment revenue was $462 million, down 69% year over year and 29% sequentially, primarily due to a decrease in semi-custom revenue. The semi-custom revenue comes from SoC sales to both Microsoft and Sony for their game consoles. Both consoles have been on the market for some time and sales have been trickling down steadily. AMD also released its latest Adrenaline software update and introduced Fluid Motion Adrenaline Software frame-generation technology.

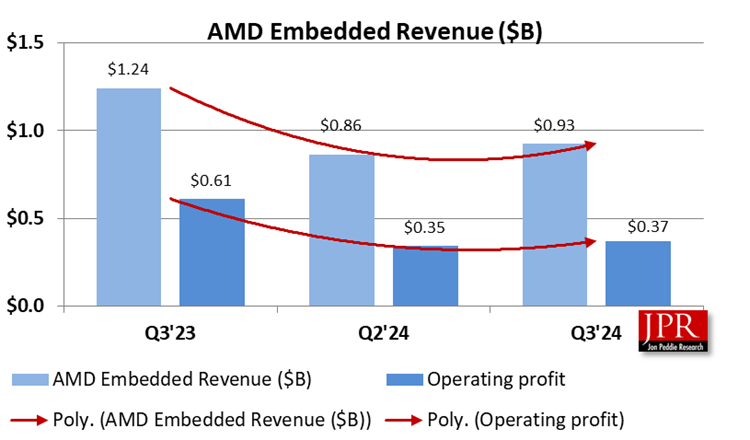

Embedded segment revenue was $927 million, down 25% year over year as customers normalized their inventory levels. On a sequential basis, revenue increased 8% as demand improved in several end markets. This is despite a busy quarter for the embedded business. The company introduced the Epyc Embedded 8004 Series processors, designed for optimal performance for high-demand workloads, launched the Alveo UL3422 Accelerator Card for ultra-low latency electronic trading applications, and the Artix UltraScale+ XA AU7P, an automotive-qualified FPGA optimized for use in ADAS sensor applications and in-vehicle infotainment.

Current outlook

For the fourth quarter of 2024, AMD expects revenue to be approximately $7.5 billion, plus or minus $300 million. At the midpoint of the revenue range, this represents year-over-year growth of approximately 22% and sequential growth of roughly 10%. Non-GAAP gross margin is expected to be approximately 54%.

AMD’s guidance for current-quarter revenue and artificial intelligence chip sales disappointed investors, sending shares down by nearly 10% in Wednesday’s trading.

Due to soaring AI chip demand from a host of large tech firms like Microsoft and Facebook, AMD needs help to provide the necessary supply of processors. In a call with analysts, CEO Su flagged that supplies of AI chips would be restrained heading into the upcoming year.

“Going into the next few quarters, we expect that the environment will continue to be tight, but we’ve also planned for significant growth going into 2025,” Su said.