Although its losses are on paper and not actual money going out the door, Intel is still seeing a notable drop across all segments.

Intel warned that this quarter would be bad, as it would take many financial charges all at once, and it was not kidding. With the worst over, the company sees better days ahead.

What do we think? As we have said previously, Wall Street hates surprises—at least the unpleasant kind. The news from Intel, while on the surface looking very bad, was expected. They took write-offs and restructured as they said they would—is the worst behind them?

They better hope that is the case, because in a “three strikes and you’re out” world, CEO Pat Gelsinger is on about his 10th strike. He can only ask for more time so many times before investors start to get impatient.

Intel can say that the worst is behind them financially, but that doesn’t change the fact that business was down across all segments, and two days ago, AMD reported rising revenue in all segments except graphics. Clearly, Intel’s problems are starting to translate into sales, or lack thereof. With all the negativity surrounding the company, it was all too easy for things to become a self-fulfilling prophecy. Speak of doom, and doom will show up. And now it is starting to happen in the form of declining sales. Up to now, Intel’s sales (and measures to counter the decline in sales) have been pretty steady, around the 80% mark to AMD’s 20%. We will see in the coming weeks as research comes out showing Q3 sales whether or not the decline is real and significant or not.

Intel’s Q3 2024 earnings fall short

How do you swing for a $17 billion loss and still have your stock go up in after-hours trading? By giving optimistic guidance and saying that the worst is over. After the bad news of the last quarter, where layoffs were announced and the dividend was suspended, Intel said the worst is over and it sees smoother sailing ahead.

Of course, that comes after the company booked billions in restructuring charges and cut most of its workforce that was going to be cut, but it said business trends are now improving.

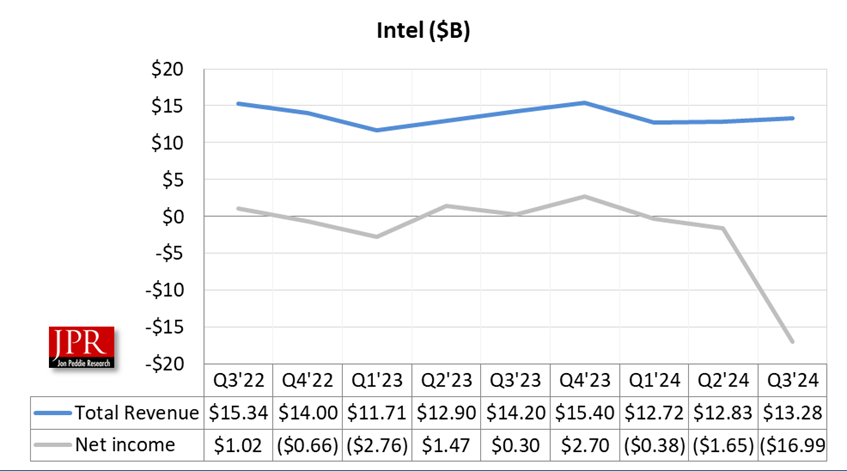

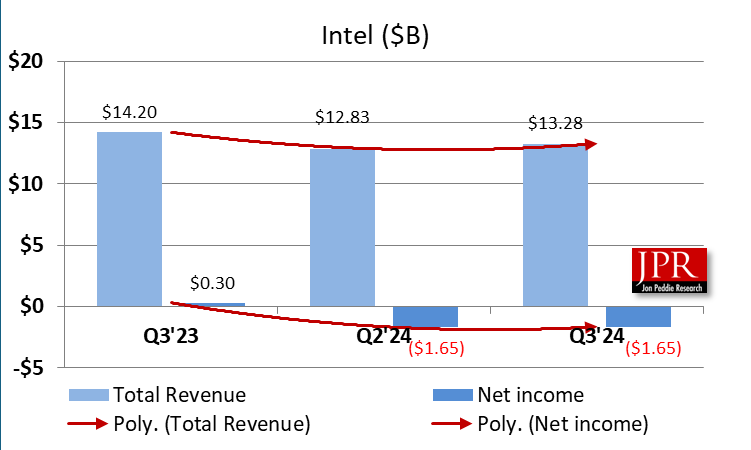

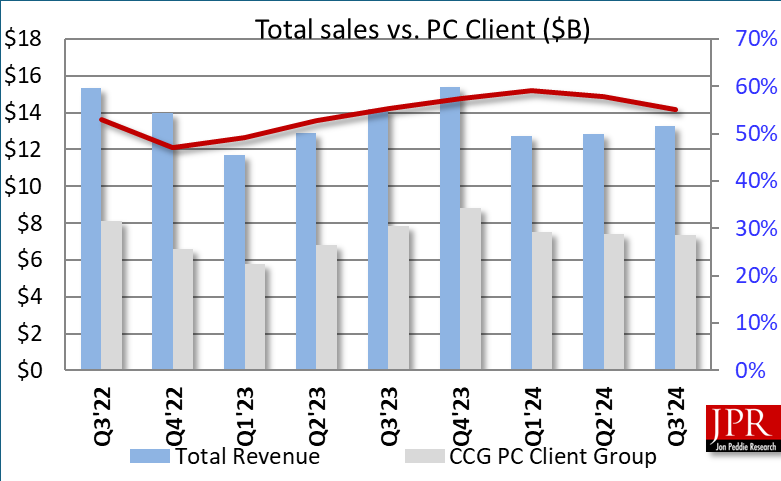

For the third quarter ended September 28, Intel’s revenue was $13.3 billion, down 6% from $14.2 billion in the same period last year and ahead of the FactSet consensus for $13 billion. Revenue rose sequentially from $12.8 billion in the second quarter.

“Restructuring charges meaningfully impacted Q3 profitability as we took important steps toward our cost reduction goal. The actions we took this quarter position us for improved profitability and enhanced liquidity as we continue to execute our strategy. We are encouraged by improved underlying trends, reflected in our Q4 guidance,” David Zinsner, Intel CFO, said in a statement.

On a GAAP basis, the gross margin was just 15%, well below the 42% of the previous year. Thanks to almost $17 billion in charges taken against revenue or depreciation of assets, the company had an operating loss of $9 billion and a net loss of $16 billion, or $3.38 per share.

It wasn’t much better on a non-GAAP basis, either. The operating margin was just 18% versus 42.5% in the same quarter last year. The net loss was $20 billion, or $.46 per share.

To say that Intel took a “rip off the bandage” approach would be an understatement. The company said it would take a huge hit in Q3, and it did just that:

- It took $3.1 billion in charges and recognized the cost of sales related to non-cash impairments in the exhilaration of depreciation for manufacturing assets. In other words, he wrote off a massive amount of older manufacturing equipment.

- It took $2.9 billion of non-cash charges associated with the impairment of goodwill for certain reporting units—primarily the Mobileye reporting unit—as well as certain acquired intangible assets.

- A massive $9.9 billion of non-cash charges related to the establishment of a valuation allowance against US deferred tax assets.

There were also restructuring charges of $2.8 billion and asset impairment charges.

Despite all that, those losses were on paper and not money going out the door. The company was cash flow positive in the quarter to the tune of $4.1 billion. Cash on hand is $8.7 billion, a 24% increase over the $7 billion it had on hand at the end of 2023.

“Q3 reflected some tough decisions we made to rightsize the business, and I want to recognize the hard work of our employees. We put some points on the board over the past few months, but we are far from satisfied. We view every quarter as a new opportunity to up our game and continue to execute well, and that is our mindset entering Q4,” Gelsinger told analysts on the conference call.

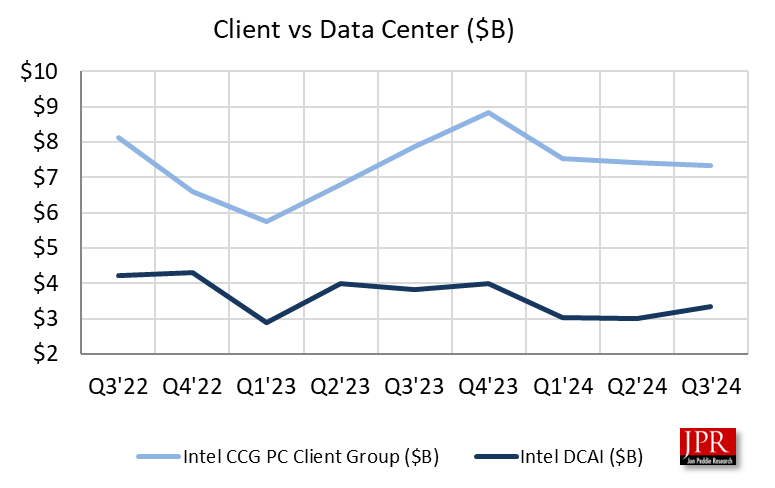

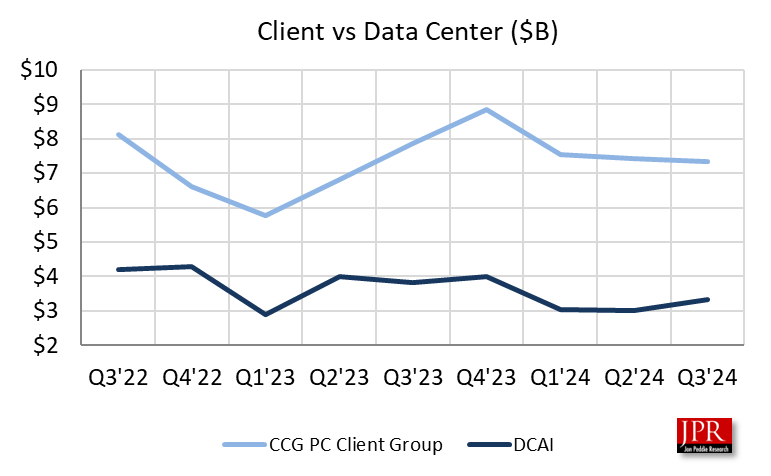

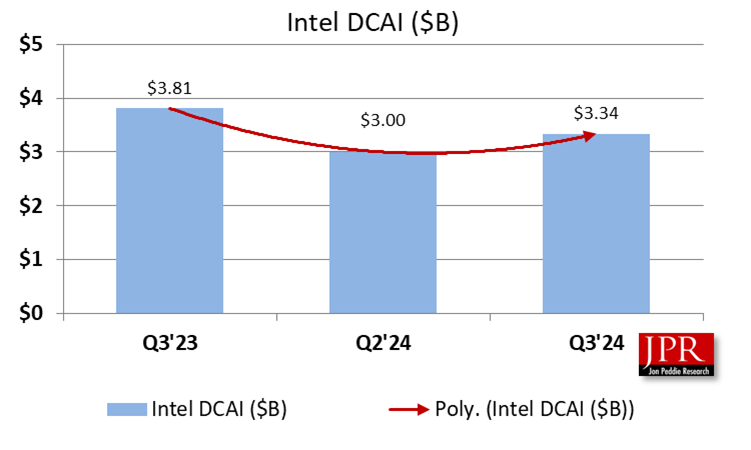

The data center business accounted for 25% of sales and brought in $3.34 billion in the quarter, an 11% rise sequentially but a 12% decline year over year. During the quarter, Intel launched the sixth generation of its Xeon Scalable processors, doubling the performance of the prior generation with increased core counts, memory bandwidth, and embedded AI acceleration.

Intel also launched its Gaudi 3 AI accelerators, claiming it delivered twice the networking bandwidth and 1.5´ the memory bandwidth of its predecessor for large language model efficiency. IBM and Intel announced a global collaboration to deploy Intel Gaudi 3 AI accelerators as a service on IBM Cloud.

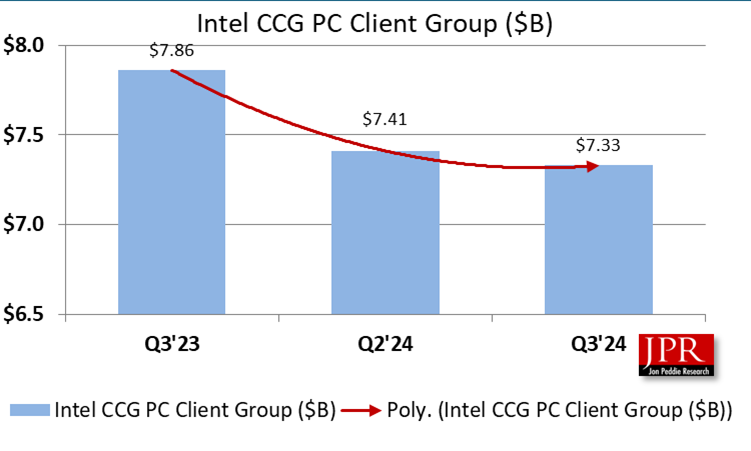

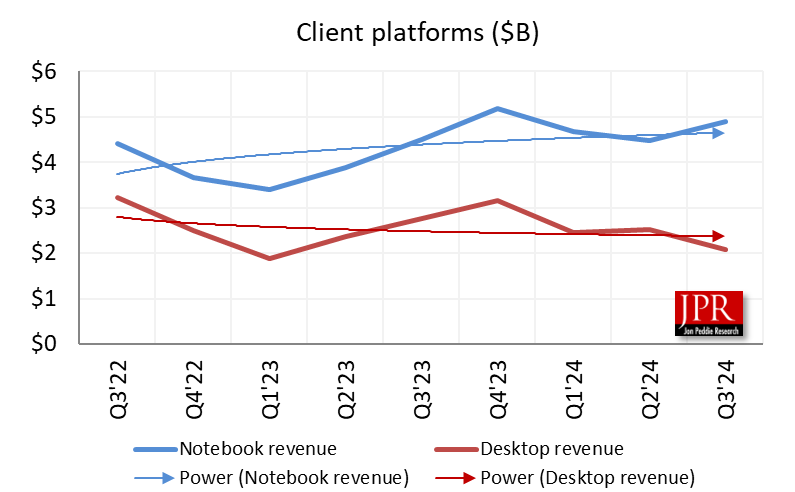

Intel’s client business accounted for 55% of total revenue but was down both on the desktop and notebook side 1% sequentially and 6.7% versus the same quarter last year. During the quarter, it launched its Core Ultra 200V-series processors, code-named Lunar Lake, delivering several more hours of battery life and gains in performance, graphics, and AI. This month, Intel launched the new Core Ultra 200S processors, code-named Arrow Lake, that will scale AI PC capabilities to desktop platforms and will be the first enthusiast desktop AI PC. The company says it is on track to ship more than 100 million AI PCs by the end of 2025.

The embedded and edge (NEX) segment saw revenue of $1.5 billion, up 4% year over year. There was one notable design win in the quarter with KDDI, a major global telecom, announcing its selection of Samsung’s vRAN 3.0 solution powered by 4th Gen Xeon Scalable processors with Intel vRAN Boost.

The foundry business was $4.35 billion, down 6.7% year over year and 1% sequentially. During the quarter, Intel announced its intention to establish Intel Foundry as an independent subsidiary to provide clearer separation for external foundry customers and suppliers between Intel Foundry and Intel Products.

Node 18A is on track for a 2025 debut, and Intel and Amazon Web Services (AWS) are finalizing a multiyear, multibillion-dollar commitment to expand the companies’s existing partnership to include a new custom Xeon 6 chip for AWS on Intel 3 and a new AI fabric chip for AWS on Intel 18A.

Current outlook

Intel’s guidance for the fourth quarter of 2024 is for revenue between $13.3 billion and $14.3 billion, with a GAAP gross margin of 36.5% and a non-GAAP gross margin of 39.5%. GAAP earnings (loss) per share is projected to be $(0.24), while non-GAAP EPS will be $0.12.