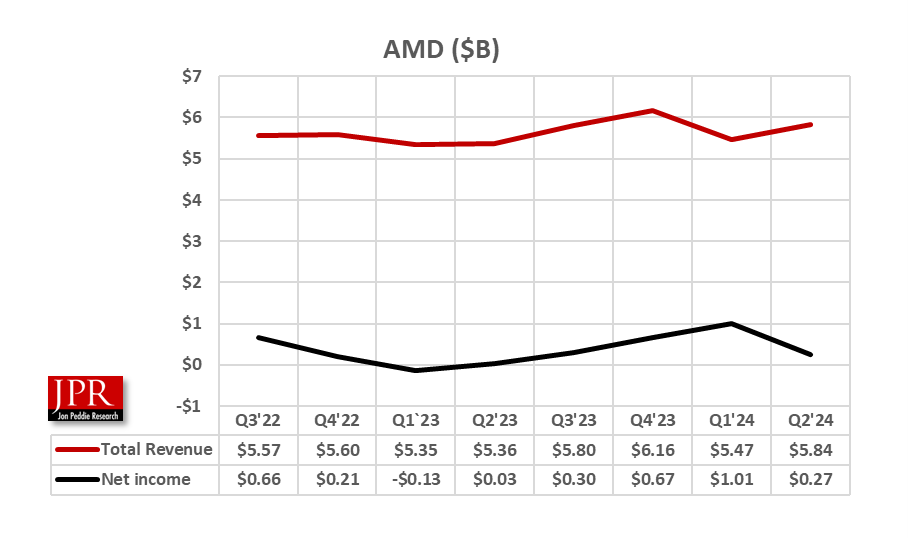

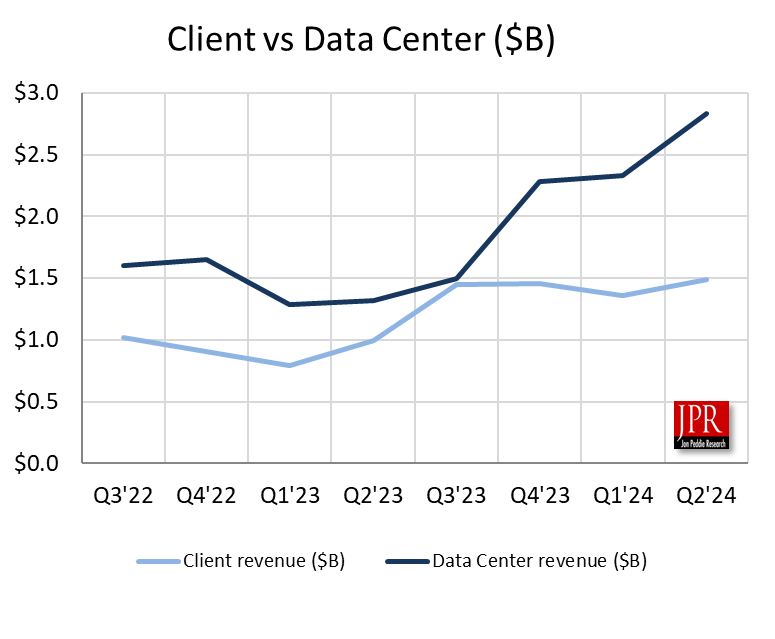

AMD reported strong financial results for Q2 2024, with revenue of $5.8 billion, up 9% from last year, driven by record Data Center segment revenue. The company saw growth in Data Center and Client segments, with data center sales accounting for 49% of overall sales. Despite a decline in Gaming segment revenue, AMD’s AI business accelerated, with strong demand for Instinct, Epyc, and Ryzen processors. The company is well-positioned for strong revenue growth in the second half of the year.

AMD announced its financial results for the second quarter of 2024, reporting revenue of $5.8 billion, a gross margin of 49%, operating income of $269 million, net income of $265 million, and diluted earnings per share of $0.16. On a non-GAAP basis, the company reported a gross margin of 53%, operating income of $1.3 billion, net income of $1.1 billion, and diluted earnings per share of $0.69.

“We delivered strong revenue and earnings growth in the second quarter, driven by record Data Center segment revenue,” said AMD Chair and CEO Lisa Su. “Our AI business continued accelerating, and we are well-positioned to deliver strong revenue growth in the second half of the year, led by demand for Instinct, Epyc, and Ryzen processors. The rapid advances in generative AI are driving demand for more compute in every market, creating significant growth opportunities as we deliver leadership AI solutions across our business.”

“AMD executed well in the second quarter, with revenue above the midpoint of our guidance, driven by strong growth in the Data Center and Client segments,” said AMD EVP, CFO, and Treasurer Jean Hu. “In addition, we expanded gross margin and delivered solid earnings growth, while increasing our strategic AI investments to build the foundation for future growth.”

The $265 million in GAAP net income is a significant improvement over the prior year of $27 million—up 881%. All segments but Gaming were up, which is out of sync with the traditional seasonality of the market, which no longer seems to apply.

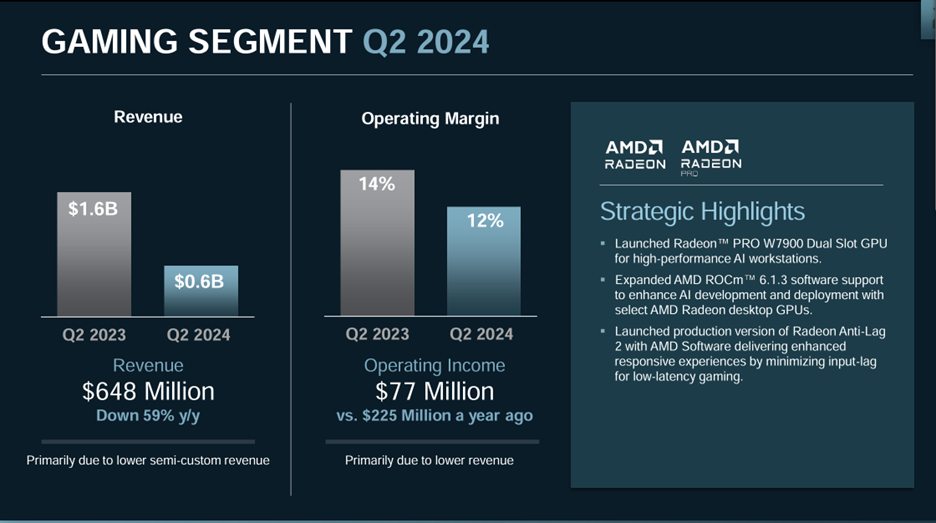

Revenue for the Gaming segment decreased 66% year over year and 49% sequentially to $648 million. Second-quarter semi-custom SoC sales declined in line with AMD projections, as we are now in the fifth year of the console cycle.

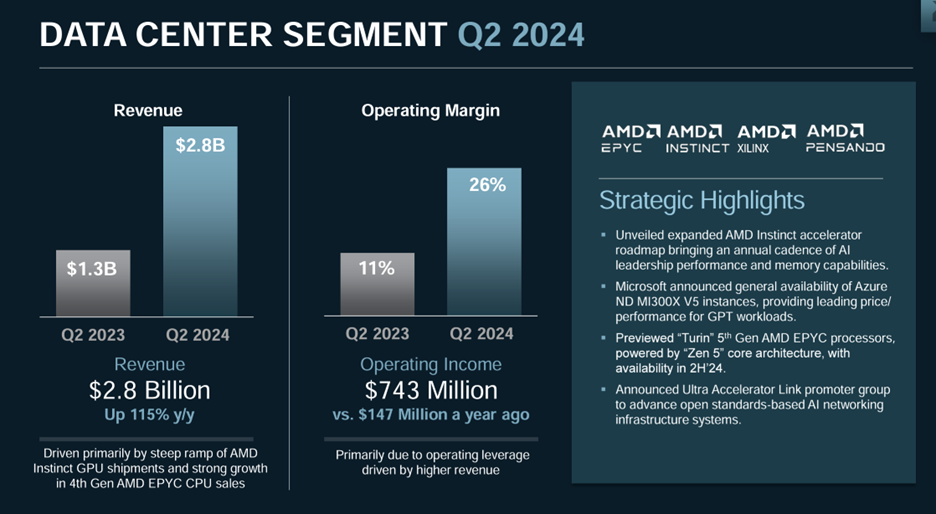

In her statements to the financial community, Su said the company had unexpectedly good results from its Instinct MI300 and Epic CPU products. She said they also saw signals of demand for its server processors. As a result, data center sales more than offset the declines in the Gaming segment. Data center sales accounted for 49% of the company’s overall sales in Q2’24. Su said AMD instances from cloud providers have increased by 34% from last year.

AMD’s embedded segment revenue decreased 41% year over year, to $861 million. The first quarter marked the bottom for AMD’s embedded segment revenue. Although second-quarter revenue was flattened sequentially, the company said it saw early signs of order patterns improving and expect embedded revenue to gradually recover in the second half of the year.

In the long term, Su said they are building strong design-win momentum for their expanded embedded portfolio. Design wins in the first half of the year increased by more than 40% from the prior year to greater than $7 billion, including multiple triple-digit million-dollar wins, combining the company’s adaptive and x86 compute products, she said.

Outlook

Looking ahead, the rapid advances in generative AI and development of more capable models are driving demand for more compute across all markets. Under this backdrop, AMD said it sees strong growth opportunities over the coming years and is significantly increasing hardware, software, and solutions investments with a laser focus on delivering an annual cadence of leadership data center GPU hardware, integrating industry-leading AI capabilities across its entire product portfolio, enabling full-stack software capabilities, amplifying its ROCm development with the scale and speed of the open-source community, and providing customers with turnkey solutions that accelerate the time to market for AMD-based AI systems. We are excited about the unprecedented opportunities in front of us, AMD said, and are well-positioned to drive our next phase of significant growth.