There were no big surprises to be had in the fourth quarter of AMD’s earnings, just more of the same steady march on Intel’s quickly fading dominance.

What do we think? AMD continues its march on Intel’s territory, incrementally increasing its sales with each passing quarter as Intel flounders. Market share is a game of inches, and inch by inch, AMD is taking more and more from Intel.

Like Intel, AMD didn’t make any bold introductions in the fourth quarter of 2024. That’s typically done in the Christmas quarter, when both companies count on big consumer sales, and usually neither is disappointed.

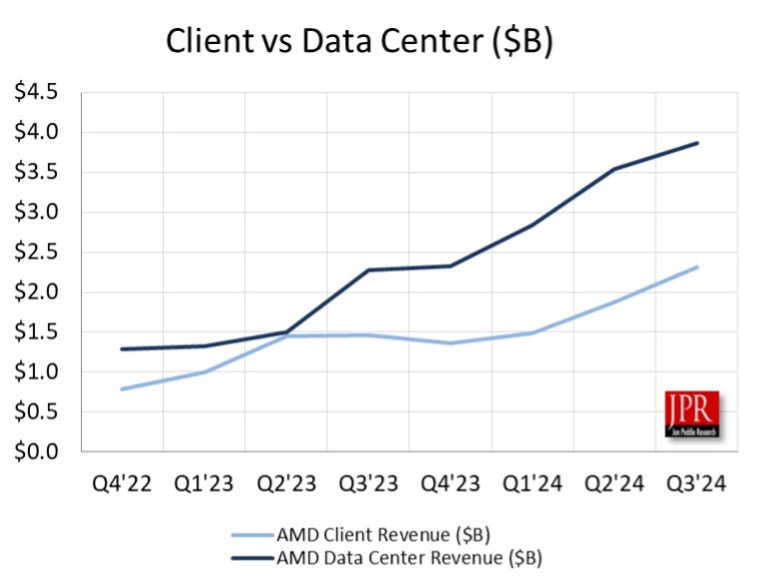

The real money is in the data center, and AMD is finally gaining some momentum. It was late to the game mostly because it had to get its house in order on the CPU side. Now thoroughly revitalized, AMD has been able to turn its attention to the AI accelerator market that Nvidia has had all to itself for several years. Most importantly, AMD is fixing its software deficiency, which has been where Nvidia has had a commanding lead. Hardware-wise, the two are fairly close in terms of performance and benchmarks, but Nvidia’s software ecosystem is miles ahead of AMD. With each passing quarter, though, AMD makes up for lost time.

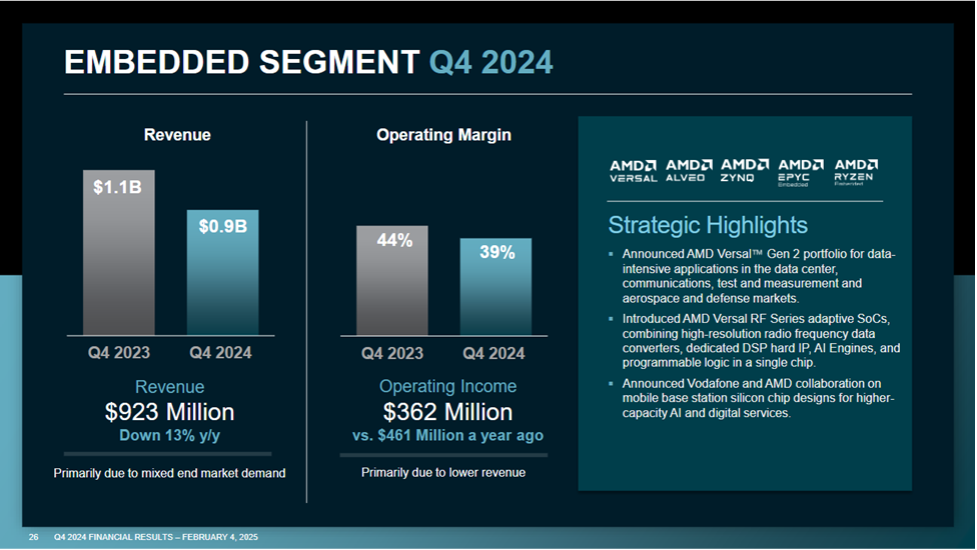

Finally, Intel and AMD have something else in common: questionable FPGA acquisitions. The embedded business is not making a whole lot of money. For all the cost ($35 billion) and painfully long acquisition (18 months), it doesn’t appear that AMD is getting a significant return on its investment.

AMD Q4 ’24 revenue sets new record high

Advanced Micro Devices (AMD) posted fourth-quarter revenue and earnings that set new records and beat expectations, but data center sales came up short despite setting a new record.

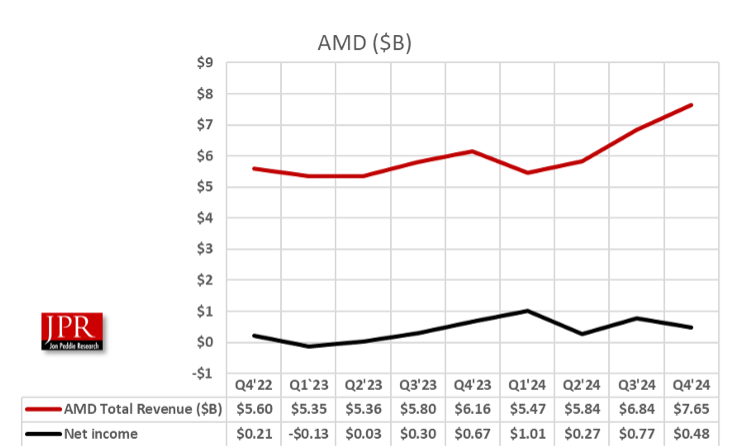

For the fourth quarter, which ended December 28, 2024, revenue was a record $7.7 billion, a 24% improvement over the same time last year and beating analyst estimates. Gross margin was 51%, operating income was $871 million, net income was $482 million, with diluted earnings per share of $0.29. That’s down from net income of $667 million, or $0.41 per share, from a year earlier.

For the full-year 2024, AMD reported record revenue of $25.8 billion, gross margin of 49%, operating income of $1.9 billion, net income of $1.6 billion, and diluted earnings per share of $1.00. On a non-GAAP basis, gross margin was a record 53%, operating income was $6.1 billion, net income was $5.4 billion, and diluted earnings per share was $3.31.

“2024 was a transformative year for AMD as we delivered record annual revenue and strong earnings growth,” said AMD Chair and CEO Lisa Su in a statement. “Data Center segment annual revenue nearly doubled as Epyc processor adoption accelerated and we delivered more than $5 billion of AMD Instinct accelerator revenue. Looking into 2025, we see clear opportunities for continued growth based on the strength of our product portfolio and growing demand for high-performance and adaptive computing.”

On a conference call with Wall Street analysts, the one significant product announcement Su discussed was the next iteration of AMD’s Instinct accelerator, the MI350, which features the next-generation CDNA 4 architecture. “CDNA 4 will deliver the biggest generational leap in AI performance in our history, with a 35 times increase in AI compute performance compared to CDNA 3,” she said.

Test silicon has come up very well, according to Su. “We were running large-scale LLMs within 24 hours of receiving first silicon and validation. Work is progressing ahead of schedule. The customer feedback on the MI350 series has been strong,” she said.

AMD results by market segment

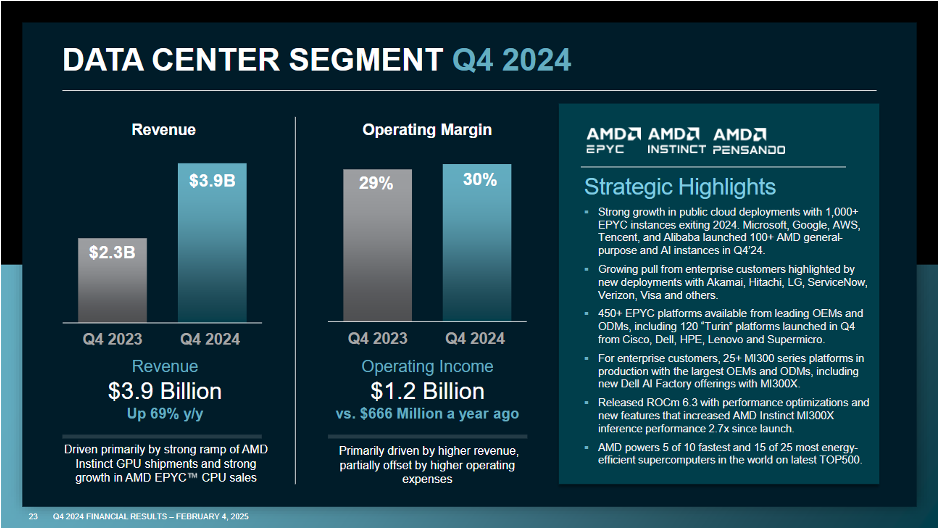

The Data Center segment’s revenue accounted for 52% of total revenue for the quarter, the first time the data center has led the way. Notable events in the quarter included the launch of the Epyc 9005 series (Turin), the introduction of the Instinct MI325X accelerators, and the planned acquisition of ZT Systems, which specializes in data center system deployment.

Data Center segment revenue accounted for 50% of total revenue for the quarter and reached a record $3.9 billion, up 69% year over year, primarily driven by the strong ramp of Instinct GPU accelerators and growth in AMD’s Epyc CPU sales. For 2024, Data Center segment revenue was a record $12.6 billion, an increase of 94% compared to the prior year.

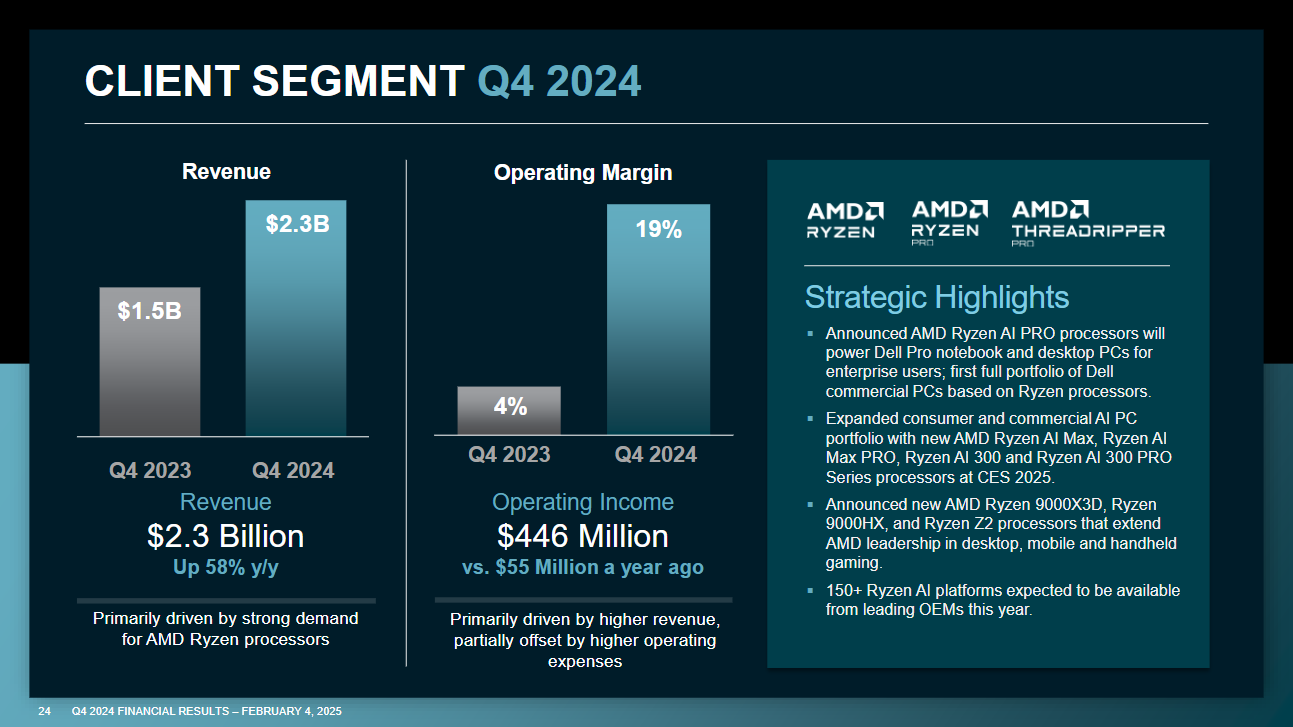

Client segment revenue in the quarter was a record $2.3 billion, up 58% year over year, primarily driven by strong demand for new Ryzen processors with 3D memory for cutting-edge gaming. For 2024, Client segment revenue was a record $7.1 billion, up 52% compared to the prior year.

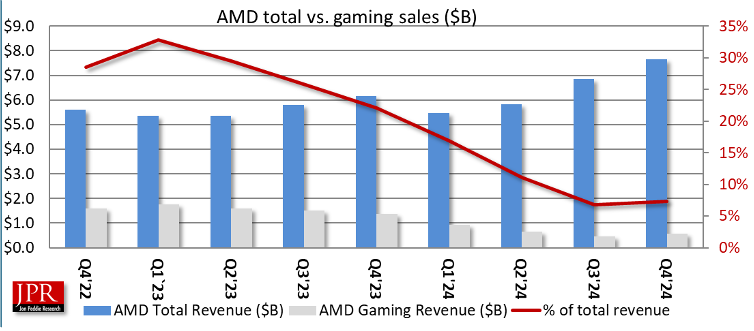

Gaming segment revenue in the quarter was $563 million, down -59% year over year, primarily due to a decrease in semi-custom revenue.

AMD makes custom SoCs for Sony’s and Microsoft’s gaming consoles, which are getting long in the tooth and due for a refresh. Su hinted at this on the earnings call, stating the two were drawing down inventory. There’s only one reason to draw down inventory: New product is on the way.

In 2024, Gaming segment revenue was $2.6 billion, down -58% compared to the prior year, primarily due to a decrease in semi-custom revenue.

Embedded segment revenue in the quarter was $923 million, down -13% year over year, as end market demand continues to be mixed. For 2024, Embedded segment revenue was $3.6 billion, down -33% from the prior year, primarily due to customers normalizing their inventory levels.

Current outlook

For the first quarter of 2025, AMD expects revenue to be approximately $7.1 billion, plus or minus $300 million. At the midpoint of the revenue range, this represents year-over-year growth of approximately 30% and a sequential decline of approximately -7%. Non-GAAP gross margin is expected to be approximately 54%.

LIKE WHAT YOU’RE READING? INTRODUCE US TO YOUR FRIENDS AND COLLEAGUES.