Samsung Electronics reported a big jump in profits from its memory business, the group that makes the precious and highly sought-after and beloved AI HBM RAM.

South Korea’s Samsung Electronics, the global leader in memory chips, reported a remarkable turnaround in its device solutions division on Wednesday. The division posted an operating profit of 6.5 trillion won ($4.7 billion) for the second quarter, a significant improvement from the 4.4 trillion won operating loss recorded in the same period last year. Additionally, the division’s revenue surged to 28.6 trillion won, nearly doubling from the previous year.”

“Driven by strong demand for HBM (high-bandwidth memory) as well as conventional DRAM and server SSDs (solid-state drives), the memory market as a whole continued its recovery. This increased demand is a result of the continued AI investments by cloud service providers and growing demand for AI from businesses for their on-premise servers,” the company said in a statement.

The news came as chipmakers raced to lead the fast-growing AI chip market dominated by Nvidia. Samsung is undergoing a qualifying process to supply its HBM chips to the company.

Likewise SK Hynix reported an operating profit for the second quarter, compared to a loss in the same period a year ago, as the chipmaker benefited from strong demand for artificial intelligence memory chips.

The world’s second-largest memory chipmaker said on Thursday that its operating profit came to 5.5 trillion won ($4 billion) for the April-to-June period, turning from a 2.9 trillion won operating loss in the previous year. Revenue increased 124.8% to 16.4 trillion won during the same period.

The company attributed the strong performance to recovery in the memory chip sector as well as rising demand for AI memory chips, including HBM.

“Continuous rises in overall prices of DRAM and NAND products with strong demand for AI memories, including HBM, led to… increases in revenues,” the company said in a statement. “With sales of premium products on the rise and exchange rate effects added in, the operating profit margin in the second quarter rose 10 percentage points from the previous quarter to 33%.”

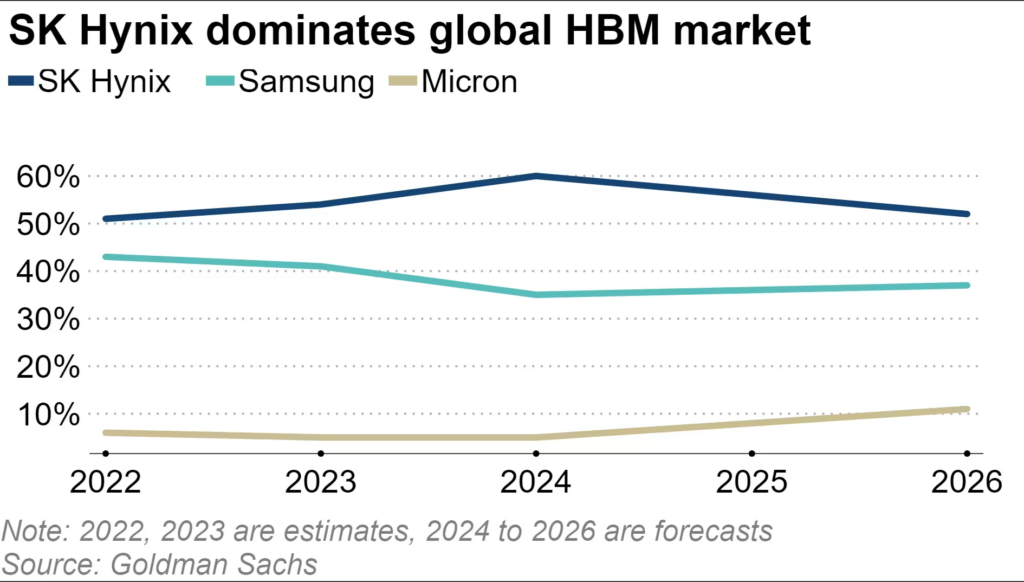

The statement continues: “SK Hynix is solidifying its dominance in the High Bandwidth Memory (HBM) market, while Samsung Electronics is working to close the gap. Historically, SK Hynix has been the primary supplier of HBM chips to Nvidia, but Samsung is currently undergoing qualification to become an alternative supplier to the US-based chipmaker. The HBM segment has been a significant contributor to SK Hynix’s financial success, with sales skyrocketing over 250% year over year in the second quarter, fueled by major tech companies’ investments in AI server infrastructure.”

During a conference call, an SK Hynix executive said, “The rapid growth of AI servers with high power consumption has led to a move to upgrade existing conventional servers to new server platforms with significantly improved power efficiency to reduce operating costs… across the data centers.”