Just a month into the job and new CEO Lip-Bu Tan has hit the ground running, making fundamental changes in significant cuts to the company. For the first-quarter 2025, Intel beat expectations, barely, but warns it’s not out of the woods yet.

What do we think? Let’s dispense with the obvious: It is far too soon to make any judgments about the state of Intel or what the new CEO Lip-Bu Tan is doing beyond saying they are good first steps. He’s only been on the job a month, and to judge him would be grossly unfair.

But the fact that he has hit the ground running and made so many bold changes so quickly indicates he’s given this some thought. He left the board of directors last year in protest because he felt they were not making bold enough changes. Former CEO Pat Gelsinger was cutting loser products like Optane, but he was nibbling around the edges. Tan has gone full Kill Bill almost immediately.

Cutting the head count by 20,000 people (if true, Intel has neither confirmed nor denied the claims by Bloomberg) is a bold move. Dumping the Altera FPGA business, even for a loss like they did, is a bold move. Flattening the business structure to be more responsive internally was a long-overdue move. Now we need to give Tan some time to see what else he does and the effects of his initial moves.

I do have to disagree with him on one thing: During the earnings call with Wall Street analysts, he declared, “The best products always win.” If that were the case, we would all be using OS/2 on our PCs, or for that matter, we’d be using Amigas. Yes, the best products often win. That’s why Nvidia is beating the pants off Intel and AMD. But that’s not always the case.

Intel reports first-quarter 2025 earnings

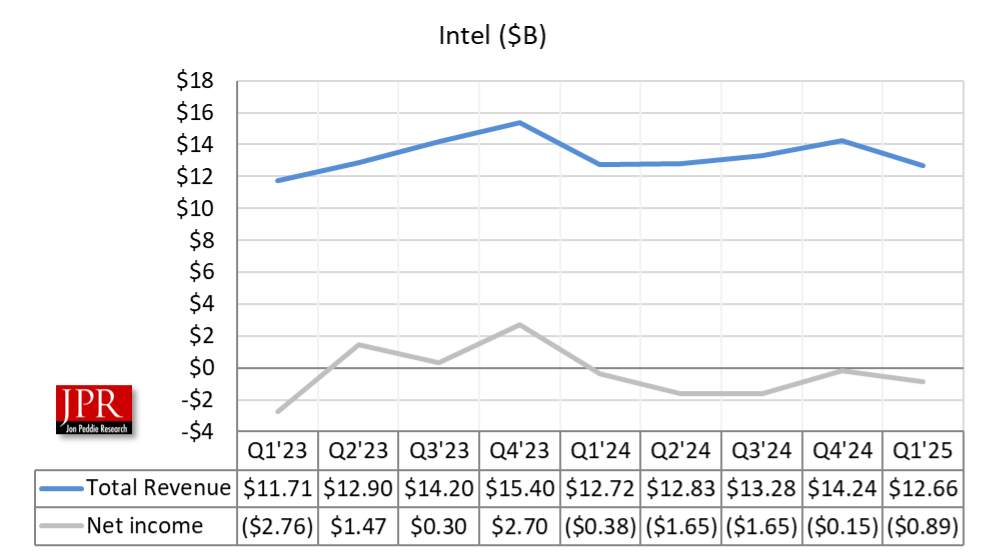

For its fiscal quarter ended March 29, 2025, Intel reported revenue of $12.67 billion, down less than -1% year over year and slightly above the analyst consensus of $12.2 billion. Gross margin was 34.4% (36.9% non-GAAP), well below the 41.0% from the same quarter last year.

Even with a significant reduction in research and development expenses, the operating loss was -$301 million, and the net loss was -$880 million, or $0.19 per share. Adjusted non-GAAP net income was $580 million, or $0.13 per share. Analysts had expected $0.12 per share.

Aside from the drop in gross margin, the other notable change from the first-quarter 2024 is a significant drop in research and development, down -16.9% from $4.3 billion to $3.6 billion.

“It is very important that we refocus our core franchise to start building best-in-class products,” Tan said on the earnings call with analysts. “Our ecosystem in client and data center computing is valuable and durable, and we still maintain a large market share in both. My focus will be ensuring that our team build products that are highly competitive and meet the needs of our customer as we enter a new era of computing defined by AI agents and reasoning models.”

To achieve this, Intel is taking a holistic approach to redefine its portfolio and to optimize its products for new and emerging AI workloads. “We are making necessary adjustments to our product road map so that we are positioned to make the best-in-class products, while staying laser-focused on execution and ensuring on-time delivery,” said Tan.

Changing operations

One of the areas that former CEO Pat Gelsinger seemed reluctant to tackle was the internal operation of Intel. Divisions didn’t talk to one another, and people set up their own little fiefdoms, where they did their own thing rather than follow the company line.

Tan is addressing that head-on, not only with the reported-but-not-confirmed rumors of a reduction in head count by 20,000, but also in changing how the company operates. “I have flattened the structure of my leadership team, and all critical product manufacturing and MG&A functions, which will spread over two to three layers, are now directly reporting to me. This will allow me to get closer to our product and engineering groups and work directly with them to close the gaps with competition more quickly,” he said.

Tan added that he will apply the same streamlining approach across the company, with a focus on “empowering our engineering talents to create great products and make it easier for our customers to do business with us.”

To accelerate this simplification, Intel is taking more costs out of the business. OpEx for calendar-year 2025 will be $17 billion, and for 2026, it will be $16 billion.

This quarter also marked the introduction of a new method of reporting. Effective Q1 of 2025, Intel is moving the edge portion of the NEX group (which stood for networking and edge) into CCG, and its auto business from All Other into CCG. The company also moved the networking portion of NEX, which includes Xeon sales, into DCAI, and the IMS equipment business out of Intel Foundry into All Other.

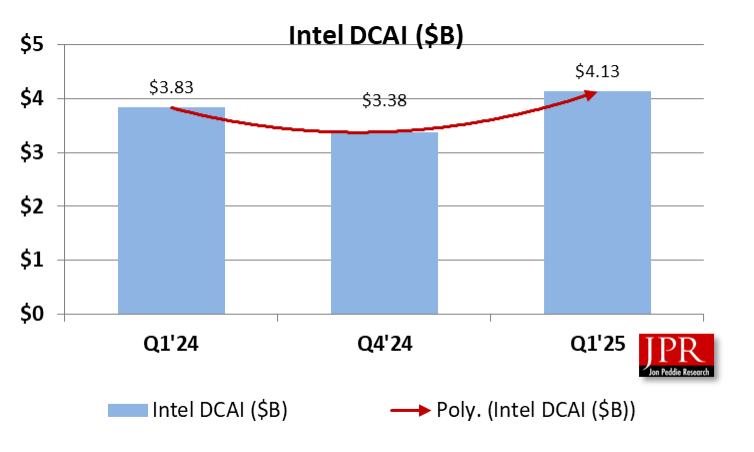

The data center business showed surprising strength in the quarter, rising 22.1% sequentially and 7.8% year over year (when adjusted for the new method of accounting) to $4.13 billion. It was a fairly uneventful quarter, with the launch in February of new Xeon 6 processors with Performance-cores (P-cores) for data center and Xeon 6 processors for network and edge applications, providing enhanced performance and efficiency across workloads.

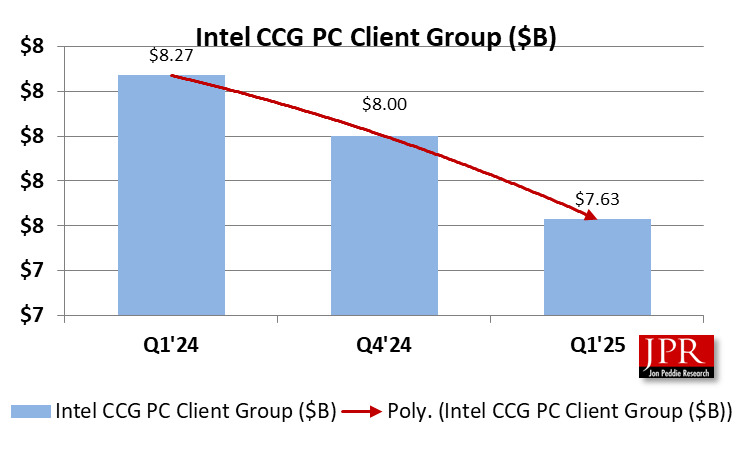

At $7.6 billion for the quarter, Intel’s client business accounted for 60% of total revenue but was down both sequentially (-4.6%) and versus the same quarter last year (7.7%). It was a fairly uneventful quarter, as Q1 typically is. At CES, Intel announced the new Core Ultra 200V-series mobile processors with Intel vPro, Core Ultra 200HX- and H-series mobile processors, and Core Ultra 200U-series mobile processors, and expanded the Core Ultra 200S-series desktop processor portfolio.

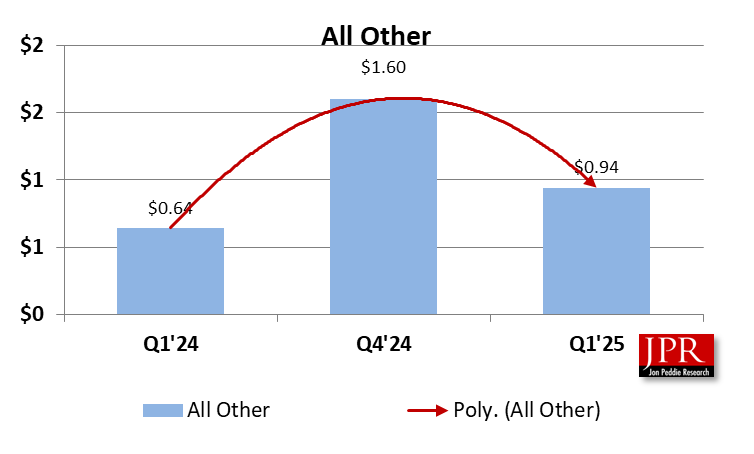

The embedded and edge (NEX) segment has been gutted in most of its products and moved to other groups. In its place is the All Other category, which includes the results of operations from other non-reportable segments not otherwise presented, including its Altera and Mobileye businesses, its IMS business, start-up businesses that support Intel’s initiatives, and historical results of operations from divested businesses. For the quarter, All Other reported revenue of $943 million, a 46% increase over the $643 million in the same quarter last year.

The Foundry business was $4.66 billion, up 7.5% year over year and 4.4% sequentially. It, however, was the one money-losing division in the company, and its -$2.3 billion loss wiped out a good amount of the profitability from CCG and DCAI.

Current outlook

Intel’s guidance for the second quarter of 2025 is for revenue between $11.2 billion and $12.4 billion, with gross margin of 34.3% GAAP and 36.5% non-GAAP. Earnings (loss) per share are projected to be -$0.32 GAAP and $0.00 non-GAAP.

LIKE WHAT YOU’RE READING? INTRODUCE US TO YOUR FRIENDS AND COLLEAGUES.