Intel barely beat its own projections, and the Client group had a decent Christmas, but there was little of note beyond that.

What do we think? The best thing we can say about Intel’s earnings is it had no big surprises. The worst thing we can say about Intel’s earnings is it had no big surprises. But it’s unreasonable to expect a massive turnaround in one quarter, when the company has been working on doing that for the past two years.

No surprises, no signs of gaining traction

When Pat Gelsinger was pushed out of the firm (for the second time), we speculated that there might be bad news on the horizon for Intel. Instead, it’s more of the same gradual decline by a company that has lost its way and now is in a holding pattern under two interim co-CEOs. This begs the question of why it was so urgent to get rid of him without a successor in the first place.

At this point, the best thing we can say is at least they aren’t in a free fall. Intel saw growth in the client space despite atrocious reviews, but the lack of momentum for the latest generation of Xeon is concerning.

And to some, it looks like Xe is dead. Not one word on GPUs during the earnings call; however, we and others know there are two more generations in the pipeline.

Last quarter, after record restructuring and layoffs, Intel declared its major issues were behind them and that the worst is over.

Just kidding. It turns out things aren’t going to turn around until 2026.

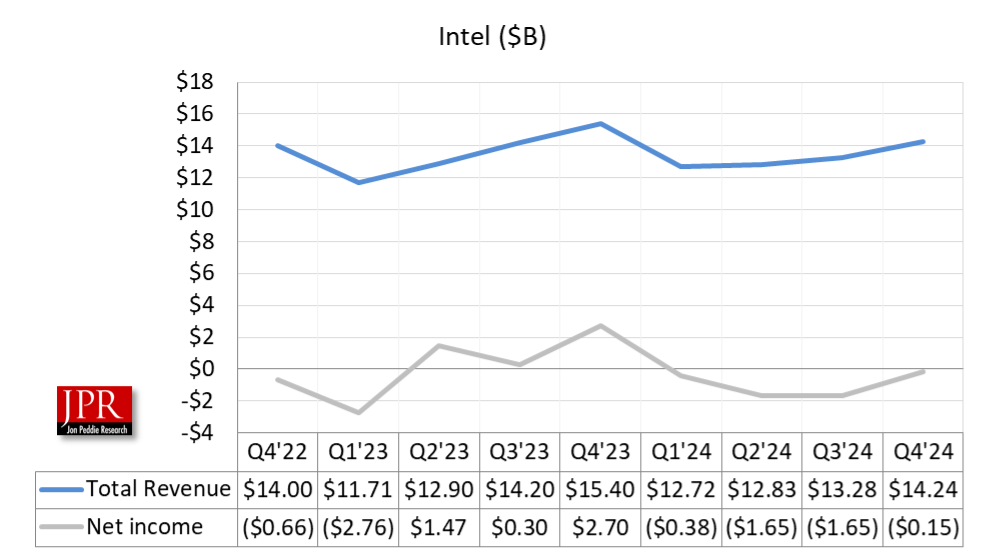

For the quarter ended December 31, 2024, Intel reported $14.26 billion in GAAP revenue, beating consensus expectations of $13.81 billion. That’s the third consecutive quarter of declining revenue, and it was off by 7% versus the same period last year.

GAAP gross margin was 39.2%, down 6.5 percentage points from the 45.7% of last year. Its own guidance for the quarter was 39.5%.

GAAP net income was a loss of $125,000 versus $2.6 billion in net profit for the same quarter a year ago. Earnings per share (loss) was $0.03 versus $0.63 per share for the same period last year. Non-GAAP EPS was $0.13, beating consensus expectations of $0.12.

For the year, GAAP revenue was $53.1 billion, down 2% from 2023. Full-year EPS (loss) was -$4.38 compared to EPS of $0.40 for 2023.

On the earnings call with Wall Street analysts, interim co-CEOs David Zinsner and Michelle Johnston Holthaus said turning things around would take time. (Isn’t that exactly what Gelsinger said too?)

“There are no quick fixes, and we are committed to improving our performance and rebuilding our credibility through persistent, hard work that delivers tangible results,” said Holthaus. “We cannot be all things to all people, and we are prioritizing areas where we can drive differentiated value. We are also continuing to simplify our business and become a leaner, more efficient company.”

That includes the search for a permanent CEO. “The search is progressing, but we have nothing new to report and won’t be able to add additional information on this topic today,” said Zinsner, who is also the company’s CFO.

Intel is betting the farm on the 18A process due in the second half of 2025, and Holthaus says the company is seen progress in performance and yields. “I look forward to being in production in the second half as we demonstrate the benefits of our world-class design and process technology capabilities. [The year] 2026 is even more exciting from a client perspective, as Panther Lake achieves meaningful volumes, and we introduce our next-generation client family code-name Nova Lake,” she said.

No bright spots, no weak spots, either

Across the board, Intel’s businesses fared about the same as in previous quarters, with no division performing badly or exceptionally well.

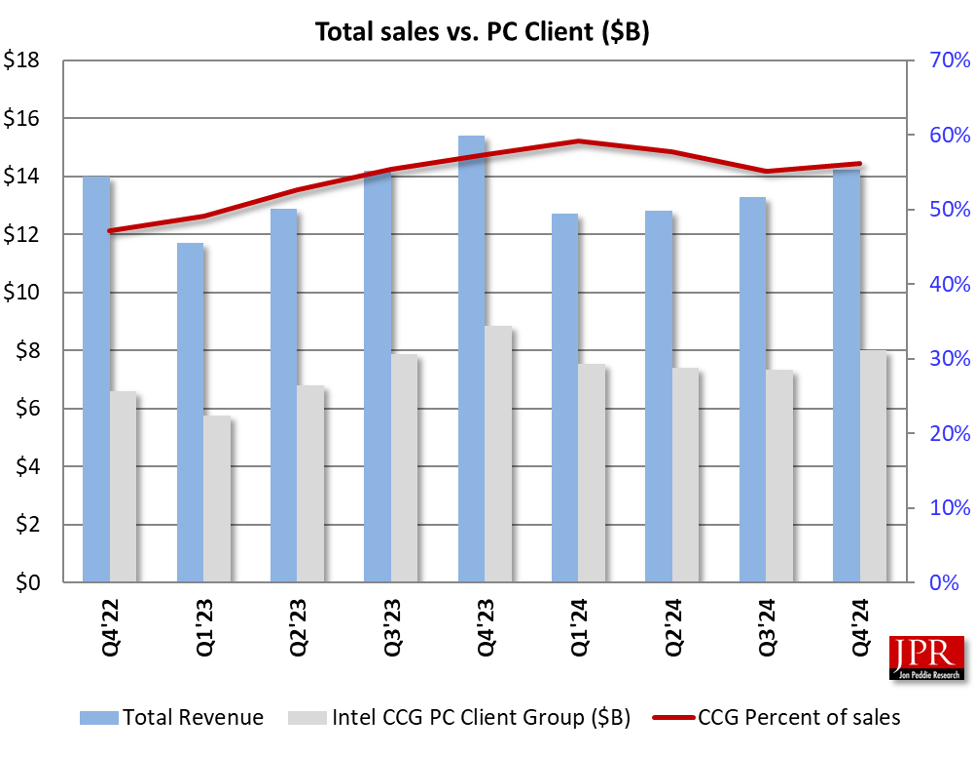

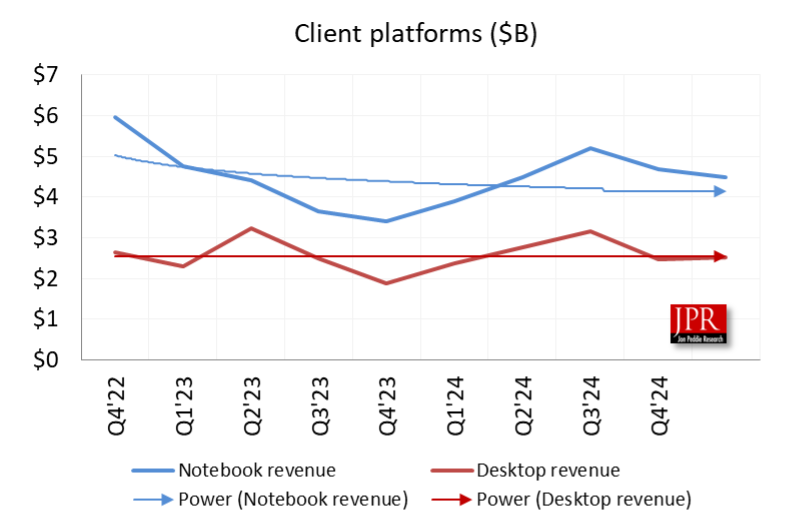

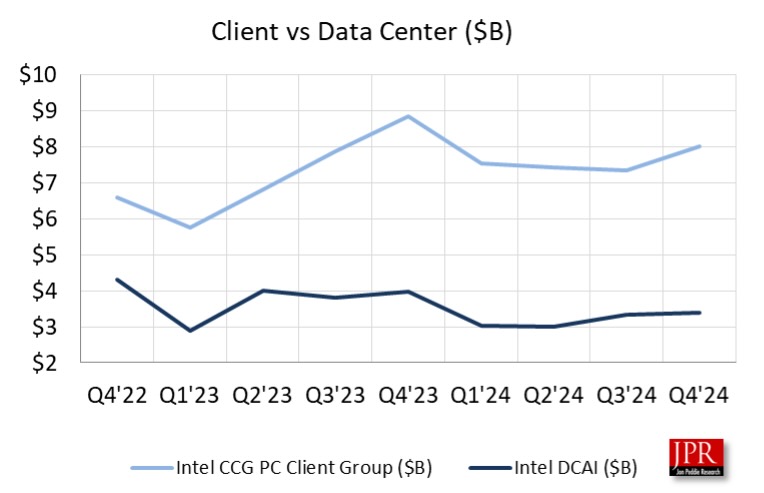

The Client Computing Group (CCG) saw quarterly revenue of $8 billion, down -9% from the $8.8 billion of the prior year. Data Center and AI Group (DCAI) reported revenues of $3.34 billion, down 15% from the $3.99 billion the same quarter of 2023. Network and Edge Group(NEX) reported revenues of $1.6 billion, up 8.8% from the prior year. The foundry business did $4.5 billion in revenue, a -13% drop from the prior year.

The Client Computing Group accounted for 58% of quarterly revenue. Intel says it is on track to ship more than 100 million AI PCs by the end of 2025 and is working on more than 400 of its features across 200-plus ISVs to optimize their software on Intel silicon. At CES, Intel introduced the Core Ultra 200V-series mobile processors with Intel vPro and also unveiled the Core Ultra 200H- and HX-series mobile processors. Panther Lake, the first product due on the Intel 18A process technology, is scheduled to ship in the second half of 2025. (FYI, we are testing the Core Ultra 9 285H and will report our findings on February 10.)

The data center business accounted for 23.7% of sales. It was a fairly slow quarter, the highlight of which was the introduction of MRDIMM memory technology, which can double the bandwidth of memory while still working in existing DDR5 hardware.

Intel’s Q4’24 embedded and foundry results

Intel’s Network and Edge Group (NEX) was even quieter than the Data Center group. In January at CES, Intel launched a new line of Core Ultra processors for edge computing, prioritizing scalability and performance across various AI applications.

In December, Intel Foundry Services achieved full tapeout of an Intel 16-based design for an external customer, with plans for volume manufacturing later this year at Intel Ireland, the company’s lead European wafer fabrication center.

Process tool installation is underway in Fab 52 in Arizona in support of ramping Intel 18A production this year.

In the quarter, Intel signed a definitive agreement with the US Department of Commerce, which awarded the company up to $7.86 billion in direct funding under the U.S. CHIPS and Science Act. Intel received $1.1 billion in the fourth quarter of 2024 and $1.1 billion in January 2025.

On the earnings call, Zinsner said Intel is aiming to get the foundry business to break-even by 2027, with Intel providing most of the sales to itself. “I think we’ll see significantly more efficiency as we work through ’25 and into ’26, so I feel good about our ability to get to break-even,” he said.

Current outlook

Intel’s guidance for the first quarter of 2025—traditionally its slowest quarter of the year—is for GAAP revenue between $11.7 and $12.7 billion, with gross margin of 33.8% on a GAAP basis and 36.0% on a non-GAAP basis. GAAP earnings (loss) per share is $(0.27), while non-GAAP EPS is projected to be $0.00.

LIKE WHAT YOU’RE READING? INTRODUCE US TO YOUR FRIENDS AND COLLEAGUES.