For the longest time, a merger of Intel and AMD was considered unthinkable. But circumstances have changed and not only is a merger worth considering, it may become necessary for x86 to survive.

Intel and AMD, bitter rivals for decades, should put their differences aside and make their tenuous connection permanent in a merger of equals.

But how can you say that when Intel has a market cap of $99 billion and AMD $230 billion? That’s a Wall Street valuation, and they are notoriously inaccurate on both the high and low side. The fact is, even with its troubles, Intel still has an 80% market share on both client PCs and servers.

The two firms are already joined at the hip through a 20 year old license agreement . While Intel was wasting its time on Itanium as its 64-bit strategy early in the 2000s, AMD came out with the 64-bit x86 extensions. When Intel gave up on Itanium, it was prepared to develop its own extensions, but Microsoft said it would not support two sets of 64-bit extensions. So Intel, in 2004, was forced to license x86-64, to its great chagrin. (A double irony because Intel already had its own x86 64-bit extension, which was killed by the clever BOD for fear it would erode its market share.)

Any potential discussion of a merger in the past would have been dismissed on competitive and antitrust grounds, but there are two very viable alternatives now. First, Arm has successfully moved from smartphones to high-end tablets and low-end laptops, and now has 10% notebook market share, according to Mercury Research.

This outlier’s increase in market share in the highly protected x86 sphere has largely been driven by Microsoft and Qualcomm, which made a considerable effort to boost the Arm market and give Microsoft more negotiation room for processors for its Surface notebook-tablets in competition with Apple. Apple moved to Arm in June 2020.

Arm is also making inroads on the server with Nvidia’s Grace Superchip, as well as in Ampere’s Altra and AWS’ home brew, Graviton. Their numbers are small but growing, and the three players are determined to make it happen—and RISC-V is right behind them.

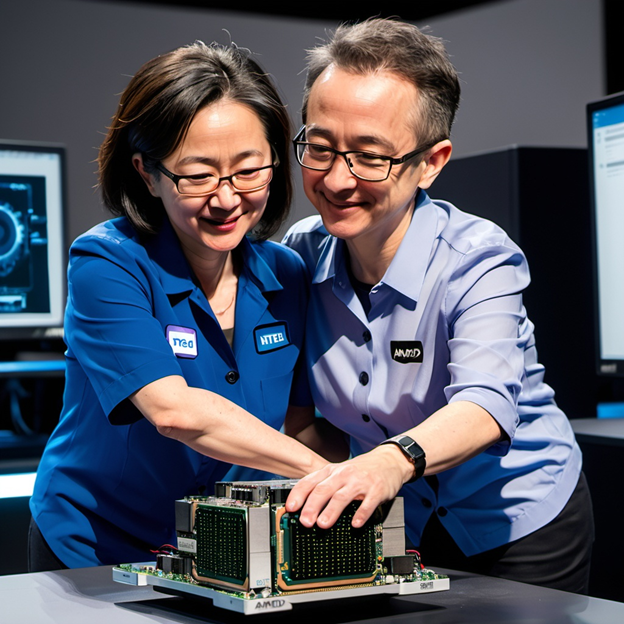

AMD and Intel are clearly feeling the heat because they recently formed the x86 Ecosystem Advisory Group, a consortium that aims to drive forward the ecosystem around x86 processors. Intel and AMD chiefs Pat Gelsinger and Lisa Su said the alliance was made to defend x86’s territory against Arm and the looming RISC-V consortium.

The other threat to x86 hegemony is AI accelerators evolved from GPUs. The x86 isn’t a consideration beyond inferencing, with the heavy lifting for training reserved for GPUs. That’s why Elon Musk bought 100,000 Nvidia GPUs for his AI factory and not 100,000 Intel CPUs or Gaudi AI processors, or AMD CPUs or Instinct AIBs.

This would not be an easy merger under the most optimistic of scenarios. The first question is, Who will lead the company? Co-CEOs seems to be the easy option, but could those giant egos survive in a boardroom without one of them pulling out a gun?

The next question is to foundry or not to foundry. AMD famously spun off its fabs in 2008 as GlobalFoundries, while Intel is trying to reinvent itself around its fabs. Again, making a safe assumption, we will suppose they will keep the fabs because Intel has built so much around them and hoping for the US government to give them billions of CHIPS and Science Act investment to maintain and grow them.

The company’s Ohio One site continues to experience construction delays for a variety of reasons, one of which is softness in the market reducing demand, but also it awaits CHIPS Act funding. Gelsinger recently complained that Intel has invested $30 billion in fabs since the CHIPS Act was passed but that the company has yet to see any CHIPS money from the feds. Worse yet for the company, the future of the CHIPS Act could be in jeopardy. Just days before the presidential election, House Speaker Mike Johnson initially indicated that the GOP is likely to “repeal” that legislation, later amending his statement to say he’d like to “streamline” it.

Next comes the product lines. They will have to merge x86, GPU, networking, and FPGA product lines (although Intel is trying to dump Altera). This will not be trivial or quickly done. The one advantage that AMD and Intel have is that there’s little to no competition in x86 (VIA has sold off everything it had to the Chinese) and FPGA. SmartNIC is another matter in the GPU business— it is beyond pitiful. According to JPR’s Q2 2024 Market Watch report, Nvidia has 92% dGPU market share versus Intel and AMD’s paltry 8% (and most of that is AMD).

It may prove to be a bridge too far. Both companies would have to sit down and talk it out, and it would depend on how much intransigence there is on both sides. However, given the state of technology in 2024, the very notion of the two merging is no longer an automatic dismissal but one for consideration.