Nvidia once again surpasses projections and sets records regarding its latest earnings, but most notably, the rumored delay in the Blackwell line is not happening.

What do we think? Perhaps it is time to rename Jensen to Neo because he sure knows how to dodge bullets. The rumored three-month delay in shipping Blackwell to its major customers—hyperscalers like Amazon, Meta, and Microsoft—proved to be a false alarm. A three-month delay is minor in the grand scheme of things, but given the expectations of Nvidia to produce, investors and analysts would’ve been running around like their hair was on fire had the delays come true.

Even though Nvidia guided to great numbers next quarter and exceeded expectations in this quarter, that wasn’t enough for Wall Street and its ridiculously high expectations. Nvidia has a valuation of over $3 trillion now, and it has to continue to grow and exceed expectations every time to justify such a lofty valuation.

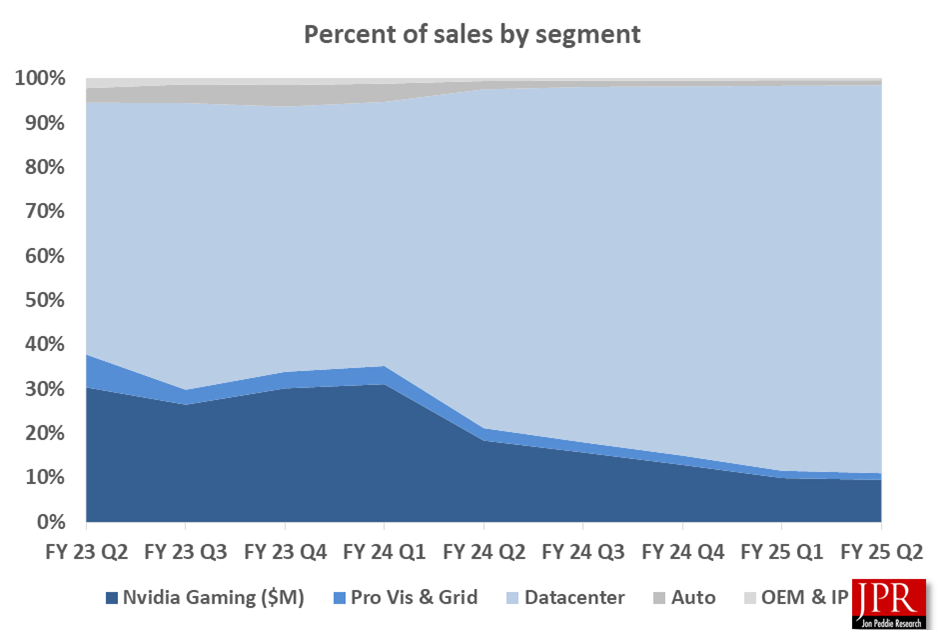

It has become unfortunate to see the gaming segment relegated to almost an afterthought like the visualization and automotive segments. The $2.9 billion in gaming and AI PC in the quarter is nothing to complain about, but it was dismissed with barely a mention on the earnings call. The networking business got more attention.

On the subject of the earnings call, CEO Jensen Huang was unusually quiet. CFO Colette Kress gave the entire speech, and he took part in the Q&A afterward. It’s not like Jensen to be this quiet, especially when he had nothing to worry about or be ashamed of.

Nvidia again beats revenue projections

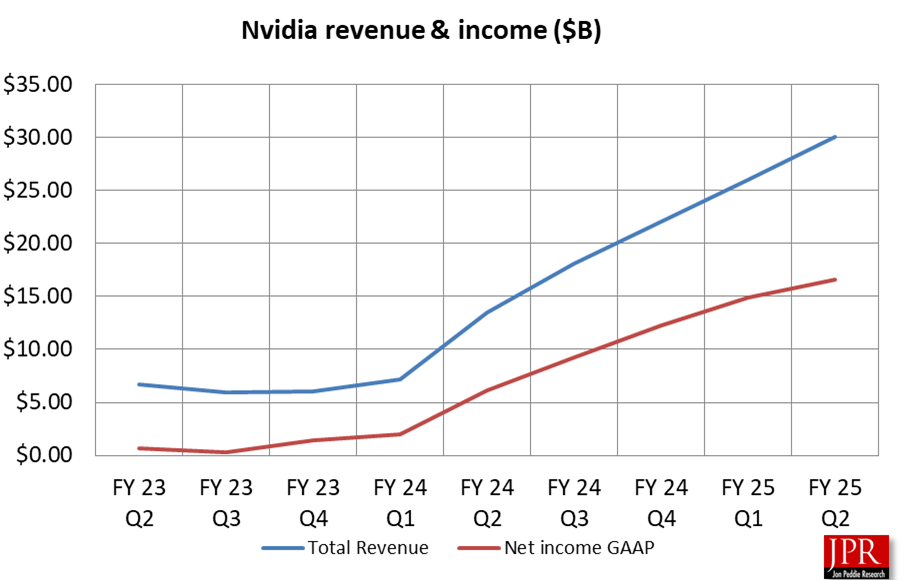

For the quarter ending July 28, 2024, Nvidia once again set a revenue record that beat expectations on the top line and bottom line. For its second fiscal quarter of 2025, Nvidia reported revenue of $30 billion, up 122% from a year ago and 15% from the previous quarter. The consensus revenue projection from Wall Street analysts was $28.8 billion.

The company reported a net income of $16.6 billion, or $0.67 per share, on a GAAP basis. Adjusted for onetime items, net income was $16.95 billion, or $0.68 per share, and will pay a $0.01 per-share dividend (2.459 billion shares as of April 30; on June 7, 2024, Nvidia completed a ten-for-one forward stock split). During the first half of fiscal 2025, the company returned $15.4 billion to shareholders in the form of shares repurchased.

Most significantly, the company said Blackwell is on track to begin shipping in the fourth quarter. This comes after a rumor that it would be delayed for three months due to manufacturing issues. The company gave no hints of any issues related to manufacturing and said everything was on track.

“Blackwell samples are shipping to our partners and customers. Spectrum-X Ethernet for AI and Nvidia AI Enterprise software are two new product categories achieving significant scale, demonstrating that Nvidia is a full-stack and data center-scale platform,” said Jensen Huang, founder and CEO of Nvidia, in a statement. “Across the entire stack and ecosystem, we are helping frontier model makers to consumer Internet services and now enterprises. Generative AI will revolutionize every industry.”

The company also announced that the board of directors approved a $50 billion stock buyback plan. This comes on top of the $25 billion buyback last year.

And yet, Wall Street wasn’t happy. The stock was clobbered by more than 4% in after-hours trading.

“Cloud service providers represented roughly 45% of data center revenue, and more than 50% stem from the consumer Internet and enterprise companies as customers continue to accelerate their Hopper architecture purchases, while gearing up to adopt Blackwell key workloads driving our data center growth,” said CFO Colette Kress on a conference call with Wall Street analysts.

Kress added that Blackwell is widely sampling with partners and, in a roundabout way, addressed the production issues that were the source of the shipping delay rumors. “We executed a change to the Blackwell GPU mask to improve production yields. Blackwell production ramp is scheduled to begin in the fourth quarter and continue into fiscal-year ’26. In Q4, we expect to ship several billion dollars in Blackwell revenue,” she said.

Data center revenue in China grew sequentially in Q2 and is “a significant contributor to our data center revenue as a percentage of total data center revenue,” said Kress, who added it remains below levels seen prior to the imposition of export controls. “We continue to expect the China market to be very competitive going forward.”

Kress went on to say demand for Nvidia products is coming from model makers, consumer Internet services and “tens of thousands of companies and start-ups building generative AI applications for consumers, advertising, education, enterprise, health care, and robotics developers.”

Nvidia may be known for its graphics, but its networking products are taking off at a rapid clip. Networking revenue increased 16% sequentially, and, in particular, Nvidia’s Ethernet for AI revenue, which includes Spectrum-X and an Ethernet platform, doubled sequentially, with hundreds of customers adopting Nvidia’s Ethernet offerings, Kress added.

Nvidia plans to launch new Spectrum-X products every year to support demand for scaling compute clusters, and Kress said Spectrum-X is well on track to becoming a multibillion-dollar product line within a year.

Total second-quarter revenue was another record, $30.04 billion, up 15.3% from the previous quarter and up 122.3% from the same period a year ago. GAAP net income was $16.6 billion, up 11.5% sequentially and 166% year over year. Gross margins were 75%.

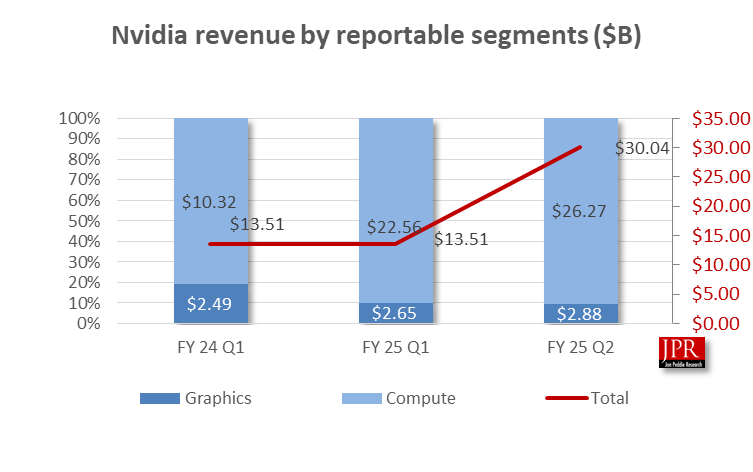

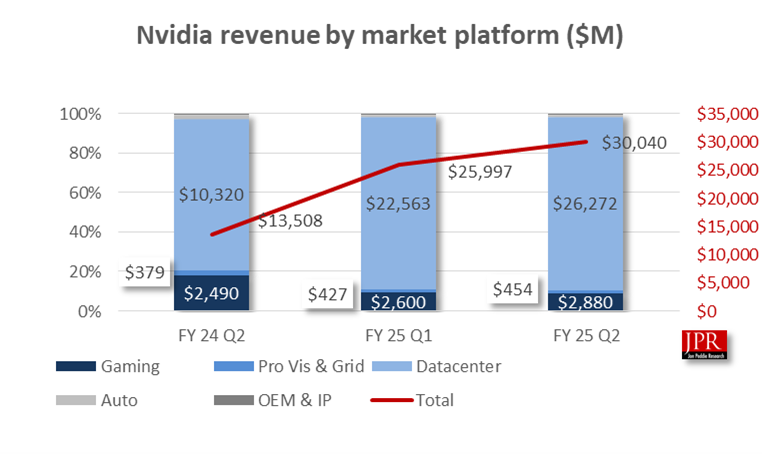

The data center business accounts for 87% of total revenue. Revenue for the quarter was $26.3 billion, up 16% from the previous quarter and up 154% from a year ago. The company announced in the quarter that H200 GPU-powered systems are now available on CoreWeave, the first cloud service provider to announce general availability.

Nvidia also introduced an array of Blackwell systems featuring Grace CPUs, networking, and infrastructure from OEM partners like Gigabyte, QCT, and Wiwynn, as well as broad adoption of its Spectrum-X Ethernet networking platform by cloud service providers.

Second-quarter gaming revenue was $2.9 billion, up 9% from the previous quarter and up 16% from a year ago. No new cards were shipped, but there was a lot of software activity. First up was the announcement of Nemotron-4 4B, a small language model for on-device inference for Nvidia ACE, a suite of generative AI gaming technologies.

In the quarter, the company said it surpassed 600 RTX games and apps to over 600 and over 2,000 games on GeForce NOW.

The second-quarter revenue for professional visualization was $454 million, which is up 6% from the previous quarter and up 20% from a year ago. In the quarter, the company introduced generative AI models and NIM microservices for OpenUSD to accelerate workflows and develop industrial digital twins and robotics.

In the automotive and robotics segment, the second-quarter revenue was $346 million, up 5% from the previous quarter and 37% from a year ago. During the quarter, world leaders in robot development, including BYD Electronics, Siemens, and Teradyne Robotics, said they are adopting the Isaac robotics platform for R&D and production.

Third quarter of fiscal 2025 outlook