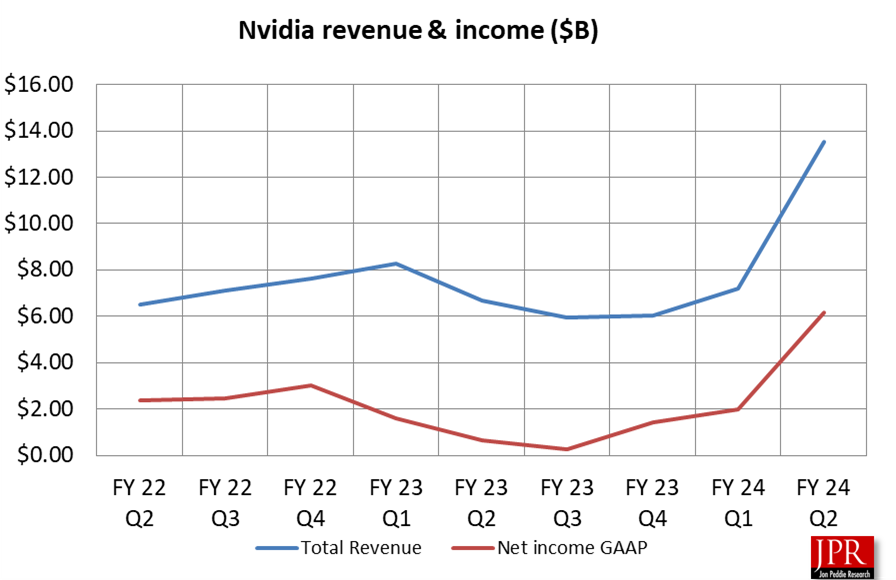

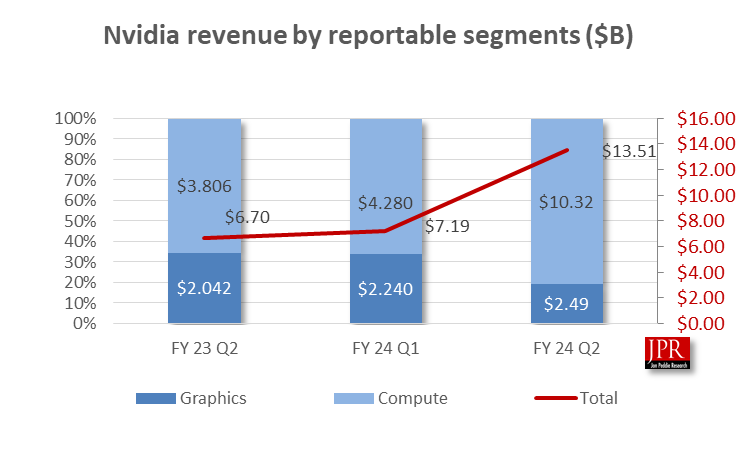

Nvidia announced its financial results for the second fiscal quarter of 2024, and the results have exceeded expectations. The figures show a record revenue of $13.5 billion, which is up 88% from Q1 and up 101% from the prior year. These numbers are attributed to data center sales. Moreover, Nvidia expects the sales increase persist in the next quarter.

Nvidia not just exceeded any and all projections, even its own, but more accurately, crushed them, for the second fiscal quarter of 2024. The company announced revenue of $13.51 billion, a 101% jump from the same period last year. Meanwhile, GAAP earnings were $6.74 billion, or $2.48 per diluted share, up 854% from a year ago and up 202% from the previous quarter. Non-GAAP earnings per diluted share were $2.70, up 429% from a year ago and up 148% from the previous quarter.

Nvidia’s income statement was enviable from top to bottom, but none more so than the gross margin of 70.1%, which is unheard of in the semiconductor space. Intel is struggling just to get to 40%.

GAAP operating expenses were up 10% from a year ago and up 6% sequentially, while non-GAAP operating expenses were up 5% both year over year and sequentially. There was very little difference between the GAAP and non-GAAP figures, indicating no significant onetime charges for the quarter.

“A new computing era has begun. Companies worldwide are transitioning from general-purpose to accelerated computing and generative AI,” said Jensen Huang, founder and CEO of Nvidia, in a statement. “Nvidia GPUs connected by our Mellanox networking and switch technologies and running our CUDA AI software stack make up the computing infrastructure of generative AI.”

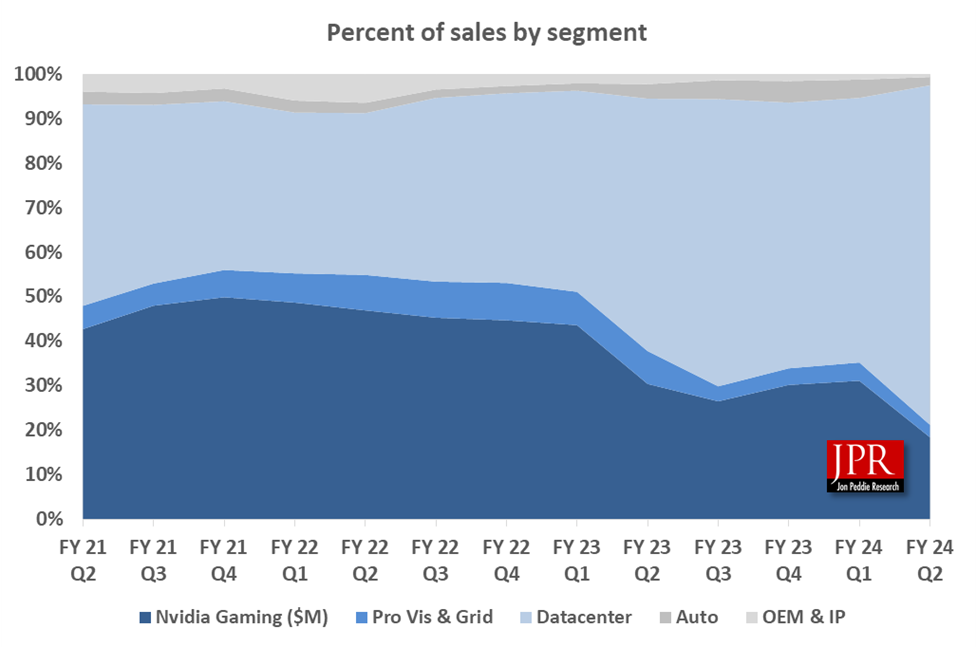

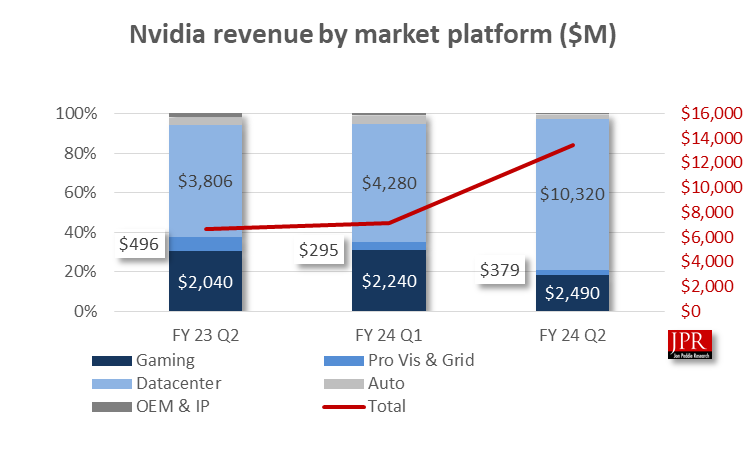

While gaming sales were up 11% sequentially and up 21% year over year, the data center segment saw a much greater leap, up 141% sequentially and 171% year over year. Of the quarter’s $13.5 billion in revenue, $10.3 billion came from data center sales. And not just those of the H100. CFO Colette Kress noted that networking revenue almost doubled year on year, driven by InfiniBand networking sales.

As for supply chain issues, that did not appear to be problematic at this point, with Kress commenting that Nvidia’s supply partners have been ramping capacity to support its needs and expects supply to increase each quarter through next year.

Revenue was $13.51 billion, up 101% from a year ago and up 88% sequentially.

Data Center revenue set yet another record, this time up 171% from a year ago and up 141% sequentially, led by cloud service providers and large consumer Internet companies. Strong demand for the HGX platform based on Hopper and Ampere GPU architectures was primarily driven by the development of large language models and generative AI. Networking was up 94% from a year ago and up 85% sequentially, primarily on strong growth in InfiniBand infrastructure to support the HGX platform.

Gaming revenue was up 22% from a year ago and up 11% sequentially, primarily reflecting demand for GeForce RTX 40 Series GPUs based on the Ada Lovelace architecture following normalization of channel inventory levels.

Professional Visualization revenue was down 24% from a year ago and up 28% sequentially. The year-on-year decrease primarily reflects lower sell-in to partners following normalization of channel inventory levels. The sequential increase was primarily due to stronger enterprise workstation demand and the ramp of RTX products based on the Ada Lovelace architecture.

Automotive revenue was up 15% from a year ago and down 15% sequentially. The year-on-year increase was primarily driven by sales of self-driving platforms. The sequential decrease primarily reflects lower overall auto demand, particularly in China.

During the first quarter of fiscal 2024, Nvidia returned $3.38 billion to shareholders in cash dividends. Nvidia will pay its next quarterly cash dividend of $0.04 per share on September 28, 2023, to all shareholders of record as of September 7, 2023.

Third quarter of fiscal 2024 outlook

Nvidia projects revenue for the second quarter of fiscal 2024 to be $16 billion, plus or minus 2%, well beyond Wall Street’s expectations for $12.5 billion in revenue.

GAAP and non-GAAP gross margins are expected to be 71.5% and 72.5%, respectively, plus or minus 50 basis points. GAAP and non-GAAP operating expenses are expected to be approximately $2.95 billion and $2.00 billion, respectively.

GAAP and non-GAAP other income and expense are expected to be an income of approximately $100 million, excluding gains and losses from non-affiliated investments. GAAP and non-GAAP tax rates are expected to be 14.5%, plus or minus 1%, excluding any discrete items.