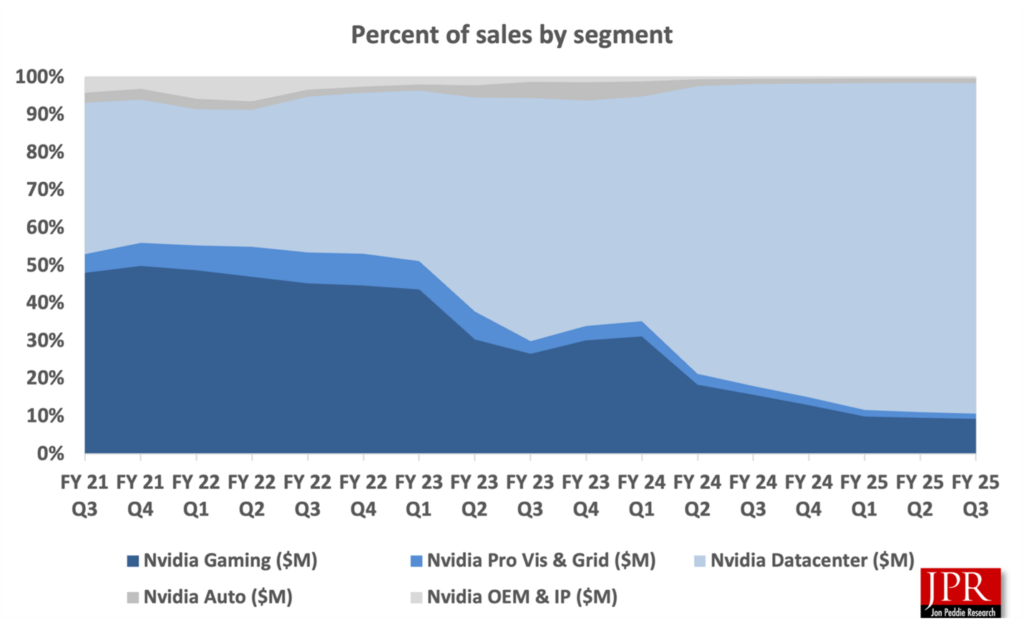

Nvidia sustains its new normal of tremendous data center sales, while the other segments also show respectable growth.

What do we think? Nvidia may be becoming too successful for its own good. Analysts have become so accustomed to insane quarterly numbers that any dip is seen as a catastrophe. It guided to a 73% growth in the next quarter instead of the expected 75%. For that, the stock gets hammered? It’s no wonder CEO Jensen Huang refuses to acknowledge negative rumors about the company, such as reports of its Blackwell processors overheating and causing potential delays in shipment.

His response to a question by a Wall Street analyst was non-direct, the same as last quarter when there were rumors about production difficulties that were eventually disproven. He simply said the company was on track to ship even more Blackwell processors than initially projected.

This is the second time now that Nvidia has been subject to FUD (fear, uncertainty, and doubt) rumors about production difficulties right before the quarterly earnings are released. No doubt the short-sellers’ knives are out for Nvidia, but this is the kind of dirty playing we see out of Washington, and the press (which includes me), so one needs to apply greater skepticism toward any rumors regarding Nvidia.

Once again, we can’t help but note the difference in the earnings call versus the competition. Huang said almost nothing compared to CFO Colette Kress. That’s not how Intel’s Pat Gelsinger and AMD’s Lisa Su roll. And there was virtually no talk of things like inventory and cash flow, standard discussions on an earnings call. Instead, we had talk about sales and alliances.

But in a way, it makes sense. Expectations are so high for the company right now that it needs to execute flawlessly every time. How long Nvidia can sustain this is another matter.

Nvidia Q3 revenue

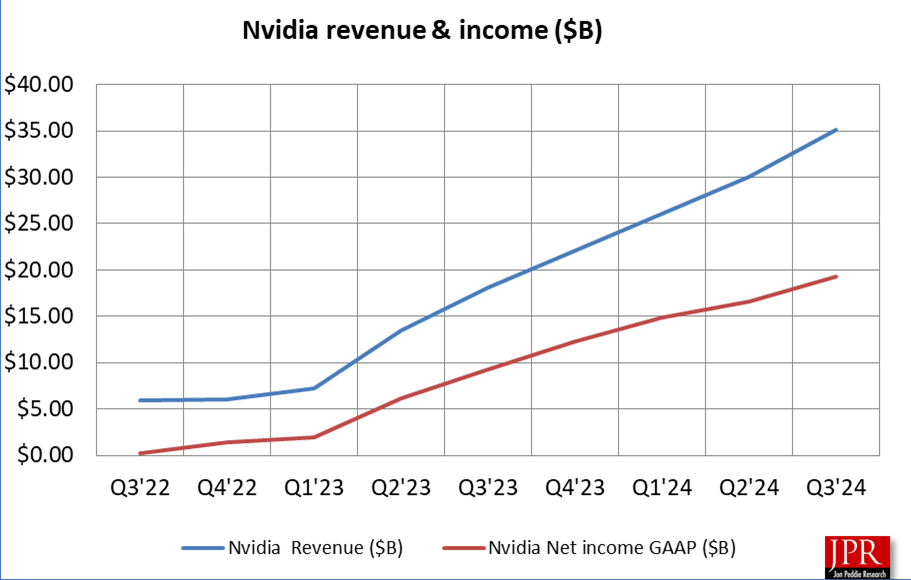

For its third fiscal quarter, which ended October 27, 2024, Nvidia earned $19.3 billion, or $0.78 per share, on sales of $35.08 billion. Analysts polled by FactSet had expected Nvidia earnings of $0.75 per share on sales of $33.17 billion.

The $35 billion in revenue was 16.8% higher sequentially over the $30 billion in the prior quarter and 93.6% higher than the $18.12 billion reported in the same quarter last year. Gross margin was 74.6%, a minor decline over the 75% reported in the previous quarter and slightly above the 74% of the same quarter last year.

GAAP net income was $19.3 billion, up 16% sequentially and 109% year over year. On a non-GAAP basis, net income was $20 billion, or $0.81 per share.

In both the earnings release and the subsequent conference call with Wall Street analysts, Nvidia said very little about the numbers, which admittedly contain no surprises. Instead, it turned the release and conference call into a product pitch.

“The age of AI is in full steam, propelling a global shift to Nvidia computing,” said Jensen Huang, co-founder and CEO of Nvidia. “Demand for Hopper and anticipation for Blackwell—in full production—are incredible, as foundation model makers scale pre-training, post-training, and inference.

“AI is transforming every industry, company, and country. Enterprises are adopting agentic AI to revolutionize workflows. Industrial robotics investments are surging, with breakthroughs in physical AI. And countries have awakened to the importance of developing their national AI and infrastructure,” he added.

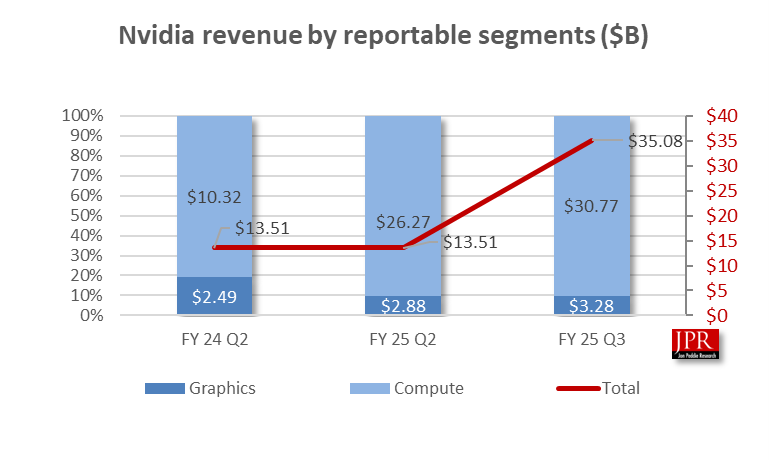

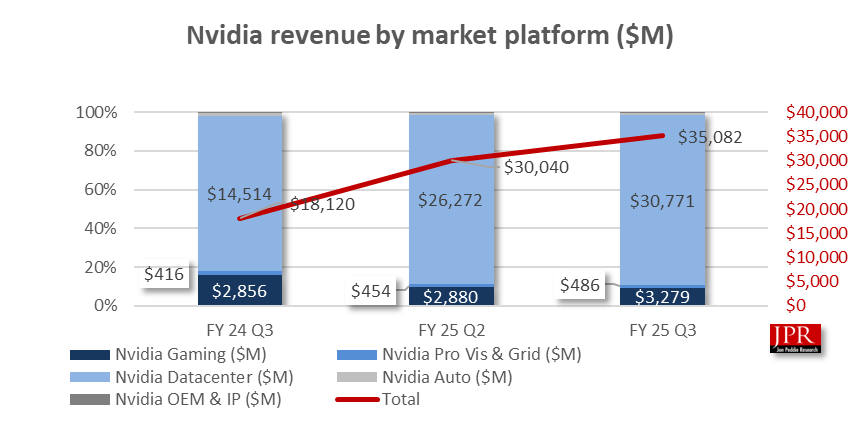

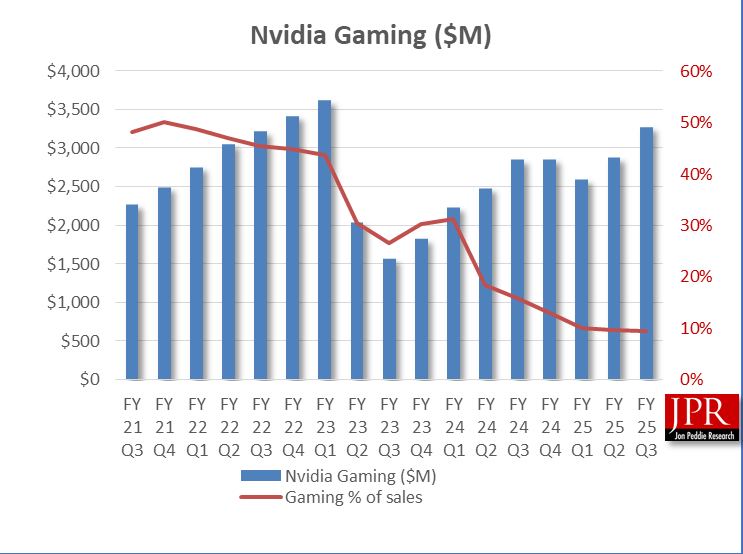

At $30.7 billion, the data center business accounted for 87% of Nvidia’s total revenue for the quarter. The next largest group was gaming and graphics, at $3.3 billion and 9.35% of total sales. Pro visualization and automotive lagged way behind at 1.4% and 1.3%, respectively.

Nvidia revenue by segment

Third-quarter revenue for the data center business was a record $30.8 billion, up 17% from the previous quarter and up 112% from a year ago. In the quarter, the company announced the availability of Hopper H200-powered instances in several cloud services, including AWS, CoreWeave, and Microsoft Azure, with Google Cloud and Oracle Cloud Infrastructure coming soon.

Among the product introductions for the quarter were the Nvidia AI Aerial platform for telecommunications providers and the announcement that SoftBank is building Japan’s most powerful AI supercomputer with the Blackwell platform and has successfully piloted the world’s first combined AI and 5G telecom network using AI Aerial.

There were also new platform announcements, including the introduction of xAI’s Colossus supercomputer cluster, which uses 100,000 Hopper GPUs, and a deal with Foxconn to build Taiwan’s fastest AI supercomputer with Blackwell parts.

On the software side, Accenture, Deloitte, and Google Cloud announced they are using Nvidia AI software to create custom AI applications, transforming industries worldwide. Nvidia also expanded its partnership with Lenovo to launch new hybrid AI solutions and systems.

The gaming segment saw a nice bump in sales to $3.3 billion, up 14% from the previous quarter and up 15% from a year ago. On the hardware side, the company announced it has begun shipping new RTX AI PCs from Asus and MSI with 321 AI TOPS performance, with Microsoft Copilot+ capabilities anticipated next quarter.

On the software side, the company introduced 20 GeForce RTX and DLSS titles, including Indiana Jones and the Great Circle and Dragon Age: The Veilguard.

Third-quarter revenue for professional visualization was $486 million, up 7% from the previous quarter and up 17% from a year ago. During the quarter, the company introduced Holoscan for Media. This AI-enabled, software-defined platform allows live media and video pipelines to run on the same infrastructure as AI, enhancing production delivery. Nvidia also struck deals with Foxconn and industrial manufacturers from India and Japan.

The automotive and robotics revenue for the quarter was $449 million, up 30% from the previous quarter and up 72% from a year ago. In the quarter, the company introduced Project GR00T, AI and simulation tools for robot learning and humanoid development, and new generative AI tools and perception workflows for robotics developers.

Fourth quarter of fiscal 2025 outlook

The outlook for the fourth quarter of fiscal 2025 revenue is projected to be $37.5 billion, plus or minus 2%. GAAP and non-GAAP gross margins are expected to be 73.0% and 73.5%, respectively, plus or minus 50 basis points. GAAP and non-GAAP operating expenses are expected to be approximately $4.8 billion and $3.4 billion, respectively.

GAAP and non-GAAP other income and expenses are expected to be approximately $400 million, excluding gains and losses from non-affiliated investments and publicly held equity securities. GAAP and non-GAAP tax rates are expected to be 16.5%, plus or minus 1%, excluding any discrete items.