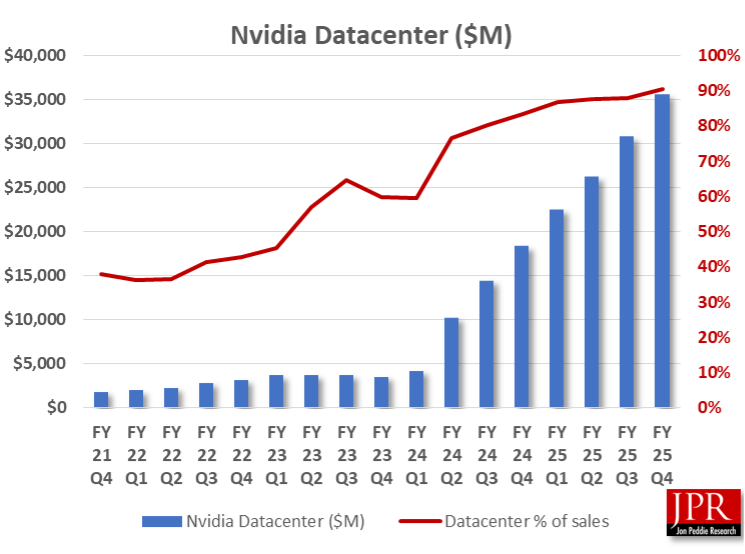

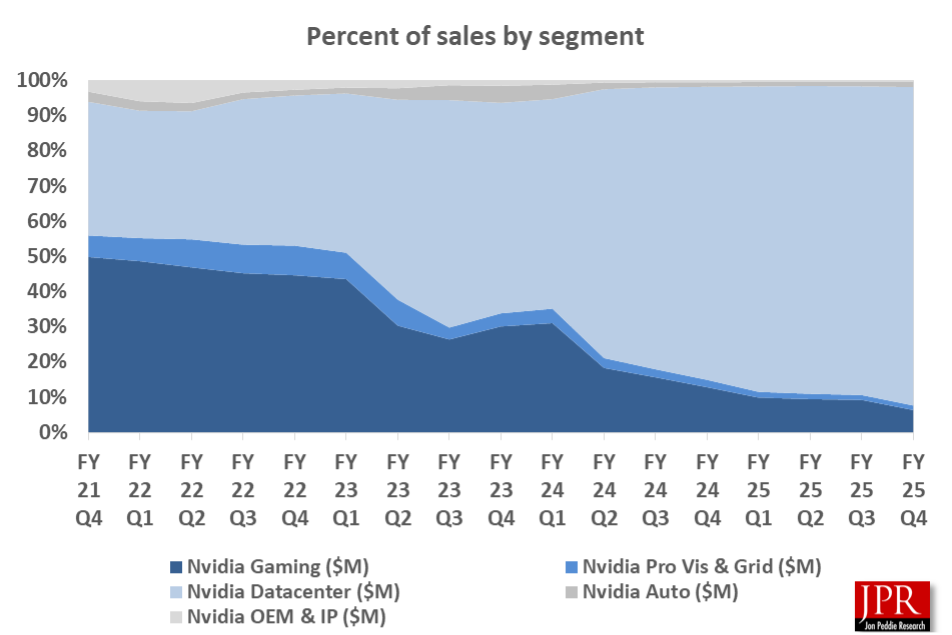

Data center revenue now accounts for 90% of all revenue at the company, with no sign of slowing down.

What do we think? Jensen Huang can dodge bullets better than Neo. Despite the punditry’s sky-is-falling cries about DeepSeek, trade tariffs, and overall economic malaise, the company just shrugs them off and does well.

Perhaps Nvidia is recognizing its significance and place in the economy. Earnings calls are now an ocean of calm, led by CFO Colette Kress, who does all the talking. Huang hardly speaks unless asked a question by an analyst. Gone are the days of complaining about supply problems or taking swipes at Intel. The subject never came up—until we asked about gaming results.

On the subject of DeepSeek, when asked if the company has changed its view on sustaining demand for their product, Huang said the company has a fairly good line of sight of the amount of capital investment that data centers are building towards and that going forward, the vast majority of software is going to be based on machine learning for accelerated computing, generative AI, and reasoning AI. In short, he’s not losing any sleep over it.

At $130 billion in 2024 revenue, Nvidia is now more than twice the size of Intel ($53 billion) and five times the size of AMD ($25 billion). It has unquestionably assumed a leadership role in the industry at large and is doing so without throwing its weight around. Or so we think.

Instead, Huang simply finds new markets to pursue. This call was all about reasoning AI, the next step in the evolution of generative AI. Reasoning models can consume 100x more compute, he said. And he will be happy to sell you that compute.

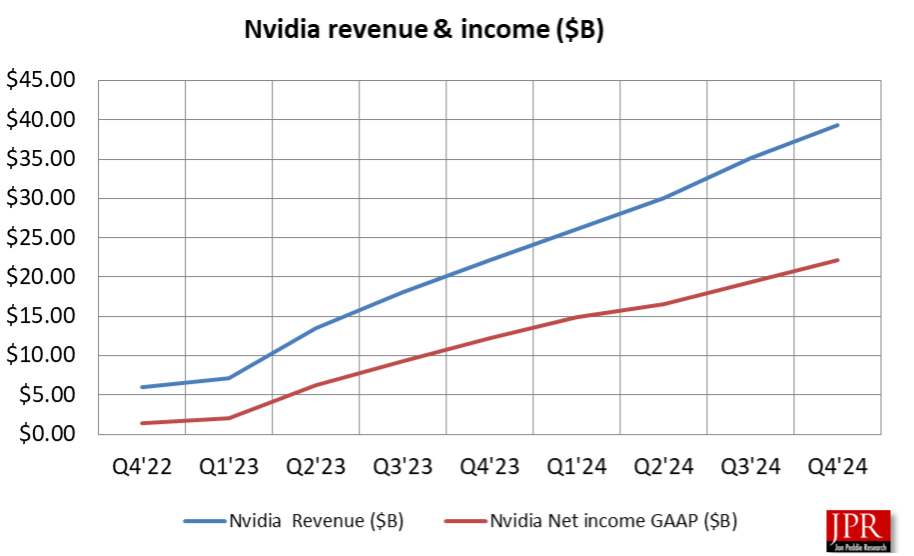

Nvidia Q4 revenue

You can breathe now.

Nvidia reported fourth-quarter in fiscal year-end earnings after the close of the market, beating its projections as well as Wall Street expectations. The company also provided strong guidance for the current quarter.

For its fourth fiscal quarter ended January 26, 2025, Nvidia reported revenue of $39.3 billion, up 12% from the previous quarter and up 78% from a year ago. GAAP net income was $22.1 billion, or $0.89 per diluted share, up 14% from the previous quarter and up 82% from a year ago.

Non-GAAP earnings per diluted share were also $0.89, up 10% from the previous quarter and up 71% from a year ago.

For fiscal 2025, revenue was $130.5 billion, up 114% from $60.9 billion a year ago. GAAP earnings were $72.8 billion, or $2.94 per diluted share was, up 147% from a year ago. Non-GAAP earnings per diluted share was $2.99, up 130% from a year ago.

“Demand for Blackwell is amazing, as reasoning AI adds another scaling law—increasing compute for training makes models smarter, and increasing compute for long thinking makes the answer smarter,” said Jensen Huang, founder and CEO of Nvidia, in a statement.

On the earnings call with Wall Street analysts, CFO Colette Kress said $11 billion of the data center revenue came from sales of Blackwell, exceeding company expectations. “This is the fastest product ramp in our company’s history… we are increasing supply, quickly expanding customer adoption,” she said.

According to Kress, with advances in models, it will be common for new clusters to start with 100,000 GPUs or more. “Post-training and model customization are fueling demand for Nvidia infrastructure and software as developers and enterprises leverage techniques such as fine-tuning, reinforcement learning, and distillation to tailor models for domain-specific use cases,” she said.

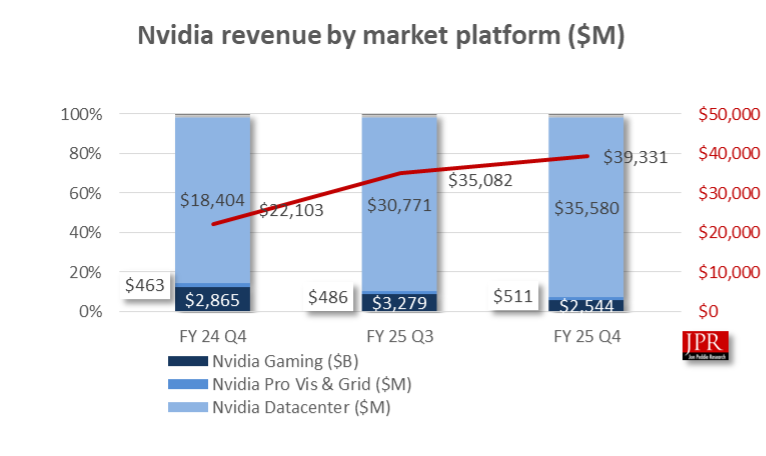

At $35.6 billion, the data center business accounted for 90% of Nvidia’s total revenue for the quarter. The next largest group was gaming and graphics, coming in at $2.54 billion. Pro visualization and automotive were their usual modest cells, notching just $511 million and $570 million, respectively.

Nvidia revenue by segment

Fourth-quarter revenue for the data center business was yet another record high at $35.6 billion, up 16% from Q3 and up 93% from a year ago. It was an eventful quarter for the data center group, with Nvidia’s involvement in the $500 billion Stargate Project to build AI data centers across the US. Cloud service providers AWS, CoreWeave, Google Cloud Platform, Microsoft Azure, and Oracle Cloud Infrastructure are all bringing GB200 systems to cloud regions around the world.

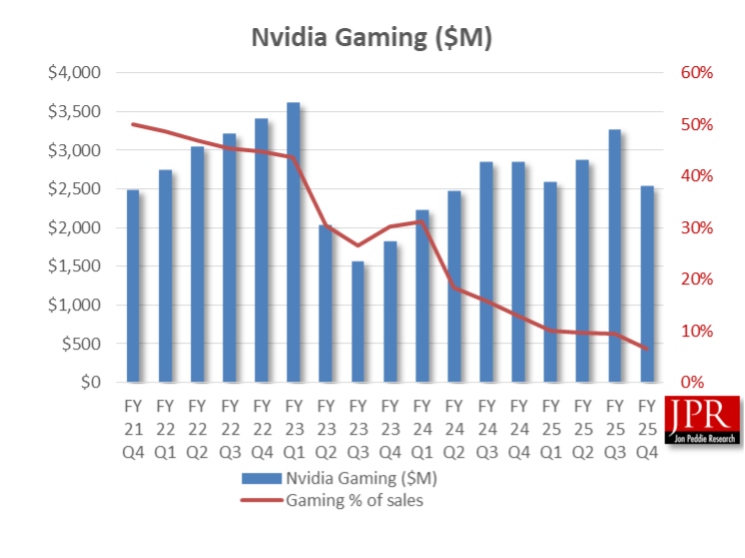

The gaming segment saw revenue of $2.5 billion, down 22% from the previous quarter and down 11% from a year ago. Full-year revenue rose 9% to $11.4 billion. Ten years ago, people would be hitting the panic button if Nvidia reported a significant loss in gaming revenue in the fourth quarter, the Christmas gift-giving quarter.

We asked Nvidia if there was a fundamental problem with the segment, since the fourth quarter is typically up, and we were told no, they just had a production limitation and that the backlog was good and Q1 would be good. One might speculate that Nvidia diverted GPU production away from gaming and toward the higher margin and higher ASP AI data center AIBs.

But most revenues are coming from data center now, and gaming had a good excuse: The new RTX 50 series was scheduled to start shipping in limited numbers, so the gaming segment got hit with the Osborne effect. Next quarter should be better.

Fourth-quarter revenue for professional visualization was $511 million, up 5% from the previous quarter and up 10% from a year ago. Full-year revenue rose 21% to $1.9 billion. During the quarter, the company unveiled Project Digits, a personal AI supercomputer that provides AI researchers, data scientists, and students with access to the Nvidia Grace Blackwell platform. The company also announced generated AI models and blueprints that expand Omniverse integration further into physical AI applications, including robotics, autonomous vehicles, and vision AI.

The automotive and robotics revenue for the quarter was $570 million, up 27% from the previous quarter and up 103% from a year ago. Full-year revenue rose 55% to $1.7 billion. In the quarter, the company announced that Toyota will build its next-gen vehicles on Nvidia Drive AGX Orin. In addition to other partnerships, the company launched Nvidia Cosmos platform and the Jetson Orin Nano Super.

First-quarter fiscal-2026 outlook

Nvidia’s outlook for the first quarter of fiscal 2026 has revenue expected to be $43.0 billion, plus or minus 2%. GAAP and non-GAAP gross margins are expected to be 70.6% and 71.0%, respectively, plus or minus 50 basis points. On the earnings call, Kress attributed the dip in margin to the shift from Hopper to Blackwell and said the margin would rise as Blackwell production increases.

GAAP and non-GAAP operating expenses are expected to be approximately $5.2 billion and $3.6 billion, respectively. GAAP and non-GAAP other income and expense are expected to be an income of approximately $400 million, excluding gains and losses from non-marketable and publicly held equity securities.

LIKE WHAT YOU’RE READING? INTRODUCE US TO YOUR FRIENDS AND COLLEAGUES.