Two leading market research firms, Canalys and IDC, have released preliminary Q3 2024 PC shipment data. Canalys estimates a 1.3% increase in total shipments to 66.4 million units, driven by notebook growth, while IDC reports a 2.4% year-over-year decline to 68.8 million units. Despite differences, both firms see a stabilizing PC market, with strong commercial demand as businesses prepare for the end of Windows 10 support. Modest growth is expected by year-end, fueled by AI processor advancements and holiday promotions. Similar findings from Gartner were also released.

Two of the three box counters have released their Q3’24 findings ahead of the financial reporting of the PC and CPU suppliers, which means they are subject to refinement. But the box counters, Canalys, Gartner, and IDC, have been doing this for a while, and their models are pretty well wrung out and reliable (±3% or so).

Canalys thinks total shipments of desktops, notebooks, and workstations are up 1.3% to 66.4 million units. Notebook shipments (including mobile workstations) reached 53.5 million units, up 2.8%, while desktop shipments (including desktop workstations) contracted -4.6% to 12.9 million units.

IDC, however, thinks worldwide shipments of traditional PCs dipped 2.4% year over year (YoY) to 68.8 million units during the third quarter of 2024 (3Q24). This includes desktops, notebooks, and workstations but does not include tablets or x86 servers. Detachable tablets and slate tablets are part of the Personal Computing Device Tracker but are not addressed.

Both first show a very stable market share among the top five or six companies, and even the other group holds pretty steady over the past five quarters. Since all the box builders use the same processors, memory, screens, and package sizes, there’s not much opportunity for differentiation unless you’re Apple, which can and does anything it wants without regard to others.

The other good news from these press releases is that the PC market seems to have stabilized.

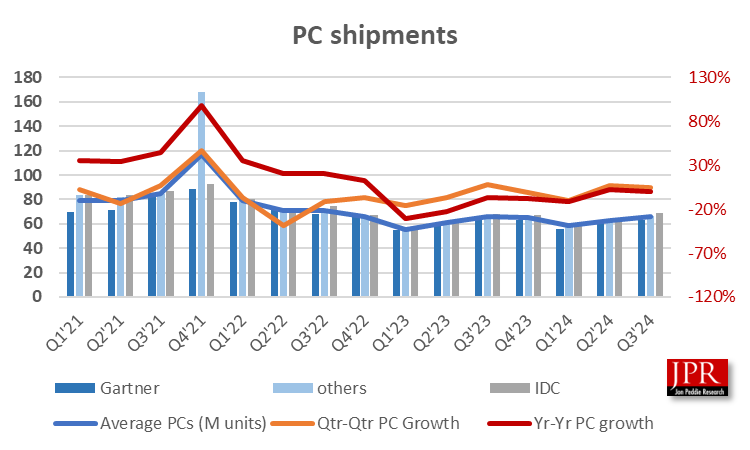

After tracking the reports over time, we generated the following chart.

IDC comments that commercial demand outside the education sector also remained strong as many businesses have begun to refresh their PCs in preparation for the end of support for Windows 10.

“After two quarters of mild growth, the market is taking a breather before going into the year-end buying period,” said Bryan Ma, vice president of IDC’s Worldwide Device Trackers. “Downside risks remain in the current geopolitical environment, but we think there is enough upside going into next year to lift the market into modest single-digit growth.”

“Although growth in Q3 was modest, the PC market recovery is now well underway with a number of positive signals indicating stronger performance in the coming quarters,” said Ishan Dutt, principal analyst at Canalys. “The uptick in demand has been especially strong from businesses, which now have just a year to upgrade their fleets to Windows 11 and avoid paying extended support fees. Commercial procurement is expected to remain elevated throughout the rest of this year, with 54% of channel partners surveyed by Canalys anticipating growth in their PC business in H2 2024 compared with the same period last year. The launch of the latest-generation AI PC processors from Intel, AMD, and Qualcomm is also strengthening the value proposition of upgrading an old PC. Consumer demand has not been as strong, but the 2024 holiday season is expected to bring significant promotional activity, which will help support modest growth toward the end of this year.”

Gartner’s view was not much different from Canalys’ and IDC’s.

So, we can all sleep a little better now, knowing the PC market is stable and poised for growth. All the box and processor builders are wetting their pants with excitement over the AI computer’s prospects, and some even think they know what one might be. Apple will explain it to them in a few weeks.