Tiburon, Calif. (June 7, 2023) – According to a new research report from the analyst firm Jon Peddie Research, unit shipments in the add-in board (AIB) market decreased in Q1 2023 by -12.6% and decreased by -38.2% year to year. Intel increased its add-in board market share by 2% during the first quarter.

The percentage of AIBs in desktop PCs is referred to as the attach rate. The attach rate grew from last quarter by 8% but was down -21% year to year. Approximately 6.3 million add-in boards shipped in Q1 2023.

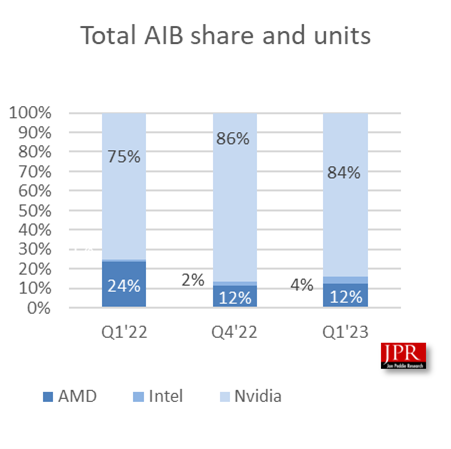

The market shares for the desktop discrete GPU suppliers shifted in the quarter, as AMD’s market share remained flat from last quarter. Intel, which entered the AIB market in Q3’22 with the Arc A770 and A750, gained 2% in market share, while Nvidia retains its dominant position in the add-in board space with an 84% market share.

Quick Highlights

- JPR found that AIB shipments during the quarter decreased from the last quarter by 12.6%, which is below the 10-year average of -4.9%.

- Total AIB shipments decreased by -38.2% this quarter from last year to 6.3 million units, and were down from 7.16 million units last quarter.

- AMD’s quarter-to-quarter total desktop AIB unit shipments decreased -7.5% .

- Nvidia’s quarter-to-quarter unit shipments decreased -15.2%. Nvidia continues to hold a dominant market share position at 83.7%.

- AIB shipments from year to year decreased by -38.2% compared to last year.

“Shipments of new AIBs were impacted by turndown in the PC market due to inflation worries and layoffs, and people buying last-gen boards as suppliers sought to reduce inventory levels. With inventory being run down, sales of new-generation boards will pick up, but not until Q3. Q2 is traditionally a down quarter, and the year won’t be any different, but probably not as severe as might be expected,” said Jon Peddie, JPR founder and president.

C. Robert Dow, analyst at JPR, noted, “Q1 2023 saw the AIB market still facing the consequences for oversupply in the market caused by pandemic-era supply chain inconsistencies and orders. The second half of 2023 promises to be brighter. AMD reported that channel sales grew sequentially for the Radeon 6000 and Radeon 7000 series GPUs. Intel, once again, committed to their next-generation Battlemage family of GPUs, bringing more competition into the gaming add-in board market, and Nvidia released its first 60 series add-in board in the Ada Lovelace family. The 60 series line of AIBs are traditionally Nvidia’s most popular with gamers.”

JPR has been tracking AIB shipments quarterly since 1987—the volume of those boards peaked in 1998, reaching 116 million units. Since Q1 2000, over 2.13 billion AIBs, worth about $490 billion, have been sold.

Pricing and availability

Jon Peddie Research’s AIB Report is now available and selling for $3,000. The annual subscription price for JPR’s AIB Report is $6,000 and includes four quarterly issues and four hours of consulting. Subscribers to JPR’s TechWatch are eligible for a 10% discount. Bundled packages are also available. For information about purchasing the AIB Report, please call (415) 435-9368 or visit the Jon Peddie Research website at http://www.jonpeddie.com/.

About Jon Peddie Research

Jon Peddie Research has been active in the graphics and multimedia fields for more than 30 years. JPR is a technically oriented multimedia and graphics research and consulting firm. Based in Tiburon, California, JPR provides consulting, research, and other specialized services to technology companies in various fields, including graphics development, multimedia for professional applications and consumer electronics, high-end computing, and Internet-access product development. JPR’s Market Watch is a quarterly report focused on PC graphics controllers’ market activity for notebook and desktop computing.

Company Contact:

Jon Peddie, Jon Peddie Research

(415) 435-9368

jon@jonpeddie.com

Robert Dow, Jon Peddie Research

(415) 435-9368

robert@jonpeddie.com