Graphics processors, stand-alone discrete devices, and embedded processor-based GPUs are ubiquitous and essential components in all computer systems and devices today from handheld mobile devices, PCs, and workstations, to TVs, servers, vehicle systems, signage, game consoles, medical equipment, and wearables. New technologies and semiconductor manufacturing processes are taking advantage of the ability of GPU power to scale. The GPU drives the screen of every device we encounter—it is the human-machine interface.

We have just released a new report on the GPUs found in PCs.

According to the typical seasonal cycles, the first quarter is typically flat to down. This year, shipments were below the ten-year average of -3.6%.

Quick highlights

-

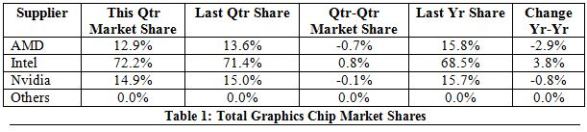

AMD’s overall unit shipments decreased -17.80% quarter-to-quarter, Intel’s total shipments decreased -12.01% from last quarter, and Nvidia’s decreased -13.5%.

-

The attach rate of GPUs (includes integrated and discrete GPUs) to PCs for the quarter was 148%, which was up 2.95% from last quarter, and 30.57% of PCs had discrete GPUs, which is up 0.39%.

-

The overall PC market decreased -14.77% quarter-to-quarter, and decreased -6.5% year-to-year.

-

Desktop graphics add-in boards (AIBs) that use discrete GPUs decreased -8.79% from last quarter—less than the PC market.

Because GPUs go into every system before it is shipped, GPUs shipments are a leading indicator of the market. Most of the PC vendors are guiding cautiously for Q2 indicating GPU shipments may be down in Q2 too.

The Gaming PC segment, where higher-end GPUs are used, was a bright spot in the market in the quarter. Nvidia’s Maxwell-based AIBs continued to do well and the company even managed to boost its market share in desktop. AMD on the other hand saw an improvement in its market share for discrete GPUs in notebooks even though the overall notebook segment dropped.

The Gaming PC segment, where higher-end GPUs are used, was a bright spot in the market in the quarter. Nvidia’s Maxwell-based AIBs continued to do well and the company even managed to boost its market share in desktop. AMD on the other hand saw an improvement in its market share for discrete GPUs in notebooks even though the overall notebook segment dropped.

The quarter in general

AMD’s shipments of desktop heterogeneous GPU/CPUs, i.e., APUs, decreased -22.6% from the previous quarter, and were down -15.0% in notebooks. AMD’s discrete desktop shipments decreased -14.55% from last quarter, and notebook discrete shipments decreased -13.6%. The company’s overall PC graphics shipments decreased -17.8% from the previous quarter. AMD is bringing out a wide range of new products for this year and hopes to pick up sales from them.

Intel’s desktop processor embedded graphics (EPGs) shipments decreased from last quarter by -12.0%, and notebooks decreased by -12.0%. The company’s overall PC graphics shipments decreased -12.0% from last quarter. The company’s overall sales were helped by devices for IoT but not enough to offset the overall decline of Q1 in the PC industry.

Nvidia’s desktop discrete shipments were down -6.96% from last quarter; and the company’s notebook discrete shipments decreased -20.8%. The company’s overall PC graphics shipment decreased -13.5% from last quarter. The company saw strength in gaming from North America and China which helped it buck a down quarter for the industry.

Total discrete GPU (desktop and notebook) shipments from the last quarter decreased -13.66% and decreased -14.28% fromQ1 2014. Sales of discrete GPUs fluctuate due to a variety of factors (timing, memory pricing, etc.), new product introductions, and the influence of integrated graphics. Overall, the CAGR from 2014 to 2017 is now -3%.

Ninety nine percent of Intel’s non-server processors have graphics, and over 66% of AMD’s non-server processors contain integrated graphics; AMD still ships integrated graphics chipsets (IGPs).

Graphics chips (GPUs) and chips with graphics (IGPs, APUs, and EPGs) are a leading indicator for the PC market. At least one and often two GPUs are present in every PC shipped. It can take the form of a discrete chip, a GPU integrated in the chipset or embedded in the CPU. The average has grown from 1.2 GPUs per PC in 2001 to almost 1.55 GPUs per PC.

It is critical to get a proper grip on this highly complex technology and understand its future direction. JPR’s MarketWatch, a detailed 50-page report, will provide you with all the data, analysis and insight you need to clearly understand where this technology is today and where it's headed.

Our findings include discrete and integrated graphics (CPU and chipset) for Desktops, Notebooks (and Netbooks), and PC-based commercial (i.e., POS) and industrial/scientific and embedded. This report does not include the x86 game consoles, handhelds (i.e., mobile phones), x86 Servers or ARM-based Tablets (i.e. iPad and Android-based Tablets),or ARM-based Servers. It does include x86-based tablets, Chromebooks, and embedded systems.

The report contains the following content

-

Major suppliers: Detailed data-on the shipments of AMD, Intel, Nvidia, and others.

-

Financial results for the leading suppliers: Analysis of the quarterly results of the leading GPU suppliers

-

Market Forecasts: You will also be able to download a detailed spreadsheet and supporting charts that project the supplier’s shipments over the period 2001 to 2018. Projections are split into platforms and GPU type.

-

GPUs: History, Status, and Analysis.

-

Financial History from for the last nine quarter: Based on historic SEC filings, you can see current and historical sales and profit results of the leading suppliers.

-

A Vision of the future: Building upon a solid foundation of facts, data and sober analysis, this section pulls together all of the report's findings and paints a vivid picture of where the PC graphics market is headed.

-

Charts, graphics, tables and more: Included with this report is an Excel workbook. It contains the data we used to create the charts in this report. The workbook has the charts and supplemental information.

Pricing and Availability

The Jon Peddie Research's Market Watch is available now in both electronic and hard copy editions, and sells for $2,500. Included with this report is an Excel workbook with the data used to create the charts, the charts themselves, and supplemental information. The annual subscription price for JPR's Market Watch is $4,000 and includes four quarterly issues. Full subscribers to JPR services receive Tech Watch (the company's bi-weekly report) and a copy of Market Watch as part of their subscription.

Click here to learn more about this major report, or to download it now. Or, for more information call call 415/435-9368 or visit the Jon Peddie Research website at www.jonpeddie.com.

Contact Robert Dow at JPR ([email protected]) for a free sample of TechWatch.

About Jon Peddie Research

Dr. Jon Peddie has been active in the graphics and multimedia fields for more than 30 years. Jon Peddie Research is a technically oriented multimedia and graphics research and consulting firm. Based in Tiburon, California, JPR provides consulting, research, and other specialized services to technology companies in a variety of fields including graphics development, multimedia for professional applications and consumer electronics, high-end computing, and Internet-access product development. Jon Peddie'sMarket Watch is a quarterly report focused on the market activity of PC graphics controllers for notebook and desktop computing.

Company Contact:

Jon Peddie, Jon Peddie Research

415/435-9368

[email protected]

Robert Dow, Jon Peddie Research

415/435-9368

[email protected]

Media Contact

Kim Stowe, Stowe Consulting

(408) 839-8750

[email protected]

###

Jon Peddie’s Market Watch is a trademark of Jon Peddie Research. All other trade names and trademarks referenced are the property of their respective owners.